Understanding Guidance Value in Bangalore: A Comprehensive Guide

What is Guidance Value?

Guidance value is the minimum value that a specific area commands and is fixed by the state government. In Bangalore, this is also known as the circle rate or ready reckoner rate in other parts of the country. It is calculated for land parcels and built-up buildings. For land parcels, the guidance value is based on the land area available, excluding any built property on it.

What is Composite Value?

Composite value is the value assigned to built properties, including the land.

What is Guidance Value in Bangalore?

The Kaveri guidance value is the minimum amount fixed in Karnataka below which a property cannot be sold in a particular location. It cannot go below this value, but there is no upper limit on the price at which a property can be sold. Any changes in the Kaveri online guidance value can directly impact the cost of the property. The stamps and registration department revises the guidance value in Bangalore periodically to keep it as close as possible to the market value of properties, thereby avoiding instances of black money and cash transactions that can affect revenue.

One should check the latest Kaveri guideline value before investing in a property in the state. When registering property transactions at the sub-registrar office, the Kaveri guidance value helps determine the stamp duty and registration charges you will be paying.

Importance of Kaveri Guidance Value

- Property Tax: Property tax is estimated based on the stamp duty, which indirectly depends on the Kaveri guidance value.

- Stamp Duty and Registration Fees: Based on the Kaveri guidance value, the stamp duty and registration fees of a property are estimated.

- Revenue Generation: The Kaveri online guidance value ensures reasonable revenue generation and prevents property undervaluation.

- Government Revenue: The Kaveri guidance value is a significant source of revenue for the Karnataka government.

BBMP to Continue with Zonal Method of Property Tax Computation

The Karnataka state government clarified on March 25, 2024, that property tax will continue to be charged based on the computational method. Bangalore will not see any hike in property tax for 2024-25. The proposed tax rates are:

| Type of Property | Tax Rate |

|---|---|

| Residential property | 0.2% of guidance value for properties on rent |

| Residential property | 0.1% of guidance value for self-occupied properties |

| Fully vacant land | 0.025% of guidance value |

| Commercial property | 0.5% of guidance value |

Note that while the rest of Karnataka is levied property tax based on the Kaveri Guidance Value, property tax in Bangalore under the BBMP ambit is based on zonal division. The property tax in BBMP is calculated based on five zonal divisions - from A to E. This results in some areas paying more property tax than others, even if they have the same built-up area.

Factors Impacting Guidance Value

- Location: A property’s location impacts its guidance value. Locations with good connectivity, sound infrastructure, and high demand have higher guidance values.

- Type of Property and Usage: The guidance value depends on the type of property, whether residential, commercial, agricultural, or industrial.

- Infrastructure Development: Good connectivity and established infrastructure increase a location’s guidance value. Proximity to landmarks and public transport also influence the guidance value.

- Amenities: Projects with better amenities can increase the guidance value of the entire location.

- Regulatory Factors: Zone restrictions, land use policies, and SEZ presence impact the guidance value.

- Demand and Supply: High demand for properties in an area increases the guidance value.

Impact of Guidance Value in Bangalore on Property Purchase

Even if you buy a property at a lower value, you will still be required to pay the stamp duty at the guidance value. According to Section 56(2)(vii)(b) of the Income Tax Act, 1961, if the stamp duty value exceeds the purchase consideration, the difference will be treated as income from other sources.

If the sale of the property happens at a higher value than the BBMP guidance value, registration takes place as per the higher value. A well-developed locality may have a higher guidance value, while areas early in the development cycle will have a lower value. Note that guidance value is just a benchmark, and a home buyer cannot persuade the property seller to sell at the guidance value. The property can be sold at any price between the guidance value and the market value without additional tax implications.

Kaveri Guidance Value Increased

Effective October 1, 2023, Karnataka has seen an increase in the guidance value by up to 50%. This hike will impact property tax as stamp duty is 5% of the guidance value in Karnataka, and property tax is 2% of the stamp duty paid for the property.

| Type | Guidance Value Increase |

|---|---|

| Agricultural land | Up to 50% |

| Sites | Up to 30% |

| Apartment | Between 5-20% |

The Karnataka government is leveraging the growing demand in the real estate segment by increasing the guidance value. The state is also pushing for online registration through the Kaveri 2.0 web-based application in Bengaluru.

How to Calculate Guidance Value in Bangalore?

The Kaveri guidance value is calculated through surveys and evaluations by the state government, considering the location’s current market conditions and potential.

Steps to Calculate Guidance Value

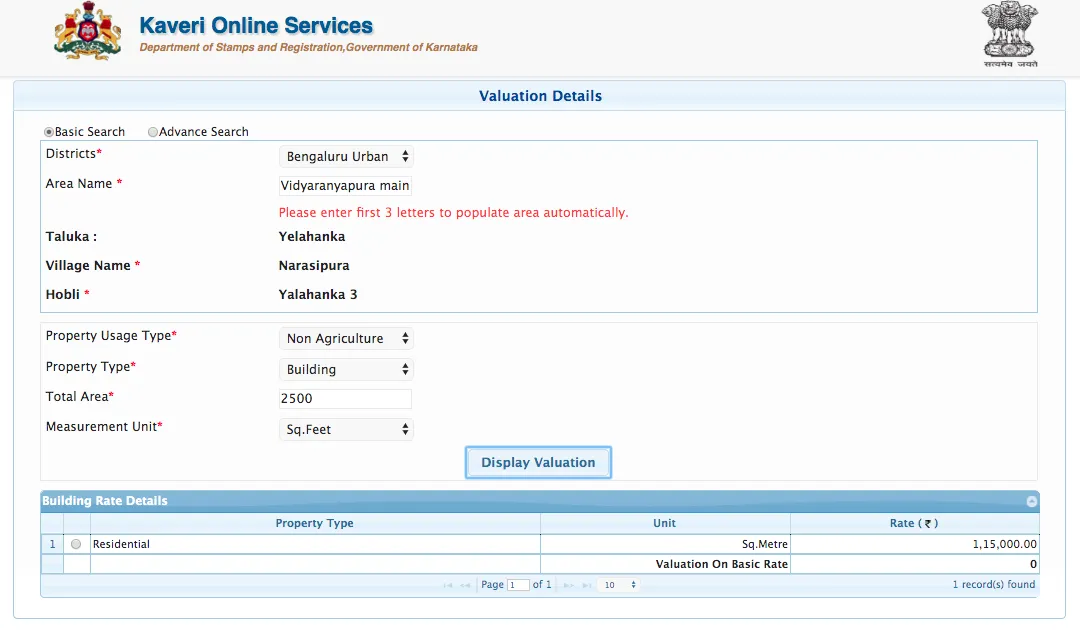

- Visit the Kaveri Website: Go to kaverionline.karnataka.gov.in to calculate the guideline value.

- Opt for Basic or Advanced Search: Choose the search type to find the guideline value.

- Enter Details: Provide details of the district, area name, property usage type, property type, total area, and measurement to calculate the guideline value. Other fields will be auto-populated, and you will see a valuation of the building rate.

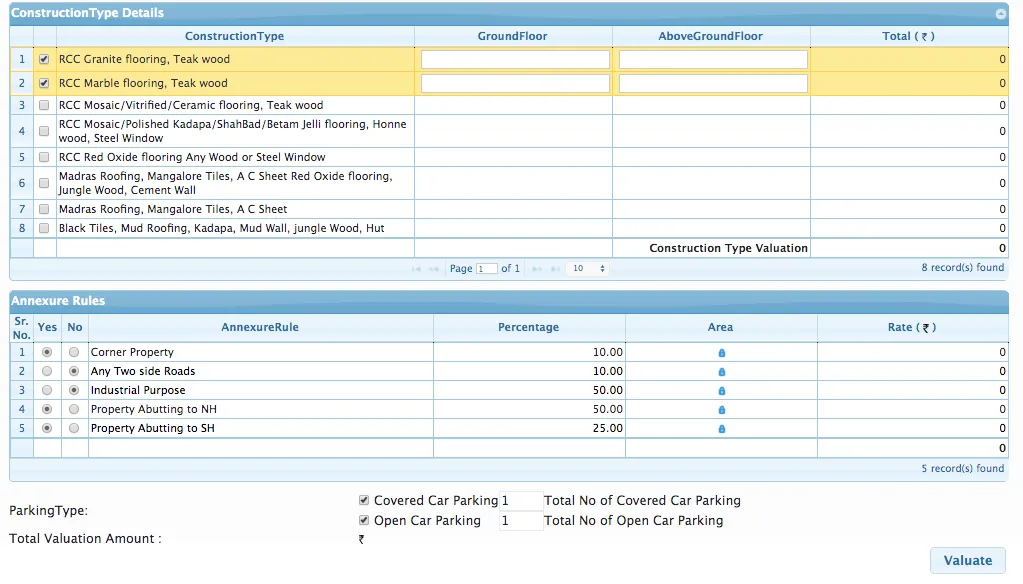

- Additional Details: Enter details about the construction type, annexure rules, parking type, etc., to get a total valuation of the property.

For an advanced search, you will need to enter extra information about the registration district and the SRO Office. There are 42 Sub-Registrar Offices (SROs) in Bangalore Urban for assessing and regulating Guidance Value Bangalore. For rural areas, the Karnataka government has set up five SROs.

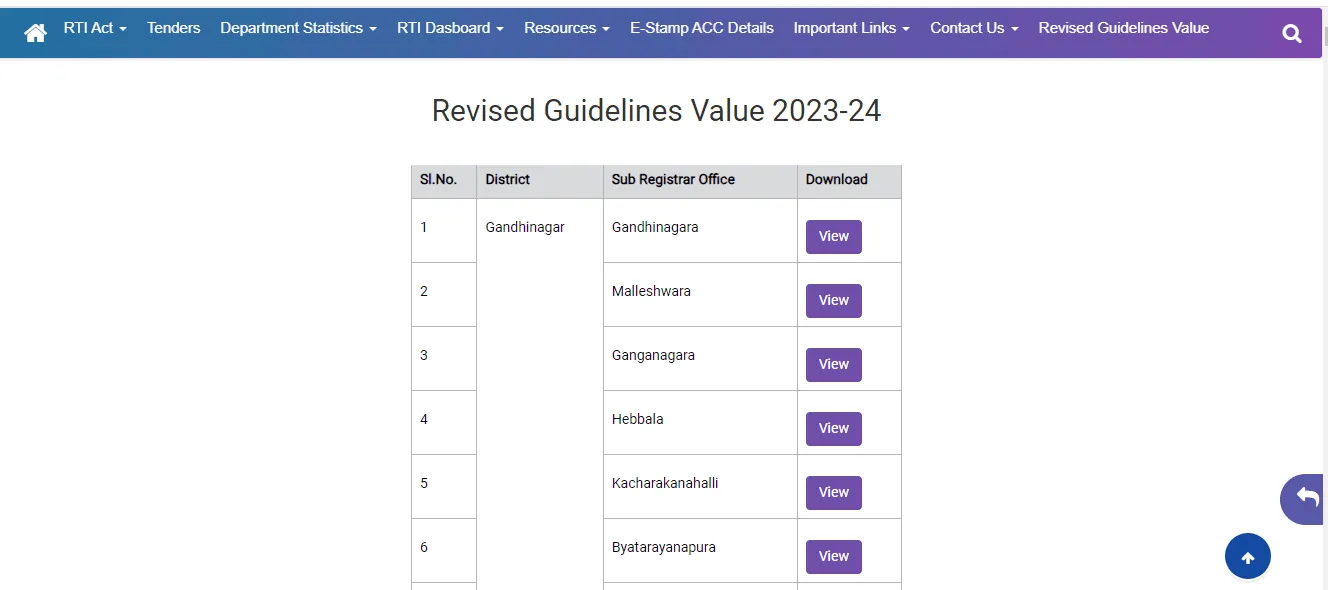

How to Check Revised Guidelines Value?

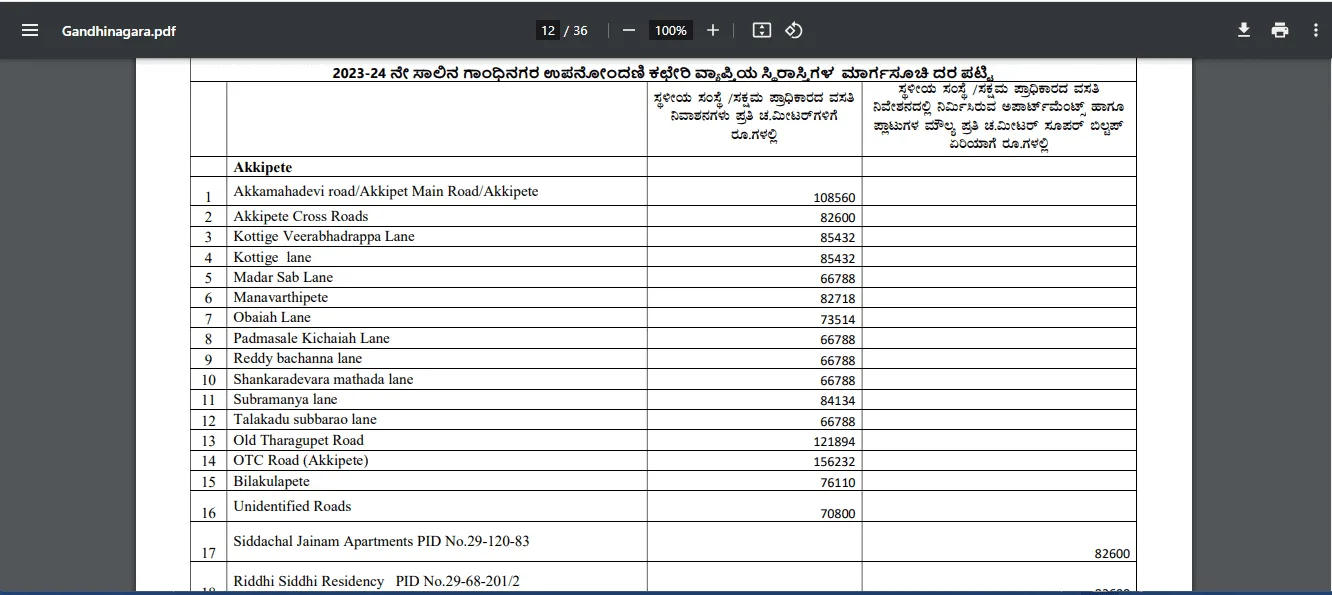

The revised guidelines value for 2023-24 can be checked on the IGR Karnataka website at https://igr.karnataka.gov.in/page/Revised+Guidelines+Value/en. In this document, you can see details like Hubli/Village/Area, competent authority, local body accommodation rate per sqm, and the rate of apartments and flats constructed in housing approved by the competent authority.

Click on “View” corresponding to the district’s SRO to see the revised guidelines value. For example, the guidelines value in Gandhinagar can be seen by clicking on “View” corresponding to Gandhinagar SRO.

Guidance Value Bangalore Example

Example 1

Jairaj Reddy decides to buy a property with a market value of Rs 6,500 per sqft. The sub-registrar guidance value in Bangalore in that area is Rs 5,000 per sqft. Home buyers can register the property at a rate between Rs 5,000-6,500 per sqft. If the property was selling at Rs 5,000 per sqft but the sub-registrar guidance value was Rs 6,500 per sqft, Reddy would still have to register it at Rs 6,500 per sqft, as it is the minimum value.

Example 2

Jairaj Reddy looks at buying agricultural land. The guidance value of agricultural land depends on connectivity to other places in Bangalore and land fertility. If these are better, the guidance value may be around Rs 4-5 lakh per acre.

Example 3

Jairaj Reddy is looking at investing in a residential site. For a premium area in Bangalore, he may have a guidance value of around Rs 1 crore per 1,200 sqft, considering amenities, accessibility, and location.

Kaveri Guidance Value vs Market Value

- Revision Frequency: Guideline value cannot be revised more than once a year, while market rates fluctuate based on market conditions and demand-supply ratio.

- Minimum Transaction Value: Guideline value is the minimum value under which a property transaction can take place, whereas the market rate is the rate a property owner can demand while selling.

- Stamp Duty Calculation: Stamp duty is calculated based on the guideline value, not the market rate.

Stamp Duty Revised in Karnataka

Effective December 11, 2023, the stamp duty in Karnataka was revised. The stamp duty paid for properties depends on the guidance value of Karnataka.

| Instruments | New Stamp Duty |

|---|---|

| Power of attorney | Stamp duty hiked from Rs 100 to Rs 500 |

| Certified copies | Stamp duty increased from Rs 5 to Rs 20 |

| Conveyance deed of amalgamation of companies | Stamp duty hiked to 5% |

| Property partition for non-agricultural uses | Stamp duty is Rs 5,000 per share in urban areas; Rs 3,000 per share in gram panchayats |

Registration Offices in Bengaluru-Urban (Zone-wise)

| Bengaluru East | Bengaluru West | Bengaluru North | Bengaluru South |

|---|---|---|---|

| Indiranagar, BDA Complex, Bangalore 560050. Telephone: 25634517 | No.488 B-Block, Karnataka Industrial Area Development Board Building, 14th cross 4th Phase, Peenya 2nd Stage, Bangalore 560058. Telephone: 28366091 | Sree Rundhreswara Chambers, Yelahanka New Town, Bangalore 560064. Telephone: 22959367 | SLN complex, Near RTS Bus Stand, Mysore Road, Kengeri, Bangalore 560060. Telephone: 28484159 |

| Domlur, BDA Complex, Bangalore 560038. Telephone: 25352907 | Sri Rameshwara Temple Commercial Complex, Near Kannada Sahithya Parishat, IIIrd Main Road, Chamarajpet. Bangalore 560018. Telephone: 26606641 | K.R.Puram, Near Santhemaala, Bangalore 560036. Telephone: 22959345 | 4th Block, Jayanagar, 12th Main Road, Near Jayanagar Complex, Bangalore 560041. Telephone: 22959347 |

| National Highway, Manjushree Chambers, K R Puram. Bangalore 560036. Telephone: 28472677 | 19/B, 2nd floor, V.K.Iyengar Road, Gandhinagar, Bangalore 560009. Telephone: 22959353 | No.69. Cholanayakanahalli, R.T.Nagar Post, Bangalore 560032. Telephone: 22959322 | Taluk office premises, Mini Vidhana Soudha, Anekal, Bangalore 562106. Telephone: 27841096 |

| No.7402, 9th ‘A’ Main. II Cross, I block, HRBR Layout, Kalyan Nagar, Bangalore 560043. Telephone: 22959335 | Near Vijayanagara Bus Stand, 2nd Main Road, Srirampura, Bangalore 560040. Telephone: 22959349 | No.13, Laggere Main Road, Andanappa Building, Parvathi Nagar Bus Stand, Bangalore 560058. | No.1105-9C, Begur Village, Bangalore 560019. Telephone: 22959328 |

| No.4, Jatar Circle Road, Whitefield, Bangalore 560066. Telephone: 22959342 | 5th Block, No 1034., Near Dhobi Ghat, Rajajinagar. Bangalore 560010. Telephone: 22959350 | No.25, D.M.Chambers, 3rd stage, RMEL Road, Jawaharlal Nehru Road, RajaRajeshwari Nagar, Bangalore 560098. Telephone: 22959329 | No.1, Madanayakanahalli, Dasanapura Hobli, Bangalore. Telephone: 22959325 |

| RBMP Building, Near Ulsoor Lake, Tank Bund Road, Bangalore 560022. Telephone: 22959369 | No.40, IInd Stage, behind BDA Complex, Block I, Nagarabhavi, Bangalore. Telephone: 22959315 | Amrutha Nagara, Konanakunte. Bangalore 560062. Telephone: 22959330 | Additional District Registrar, BDA Complex, Kumara Park West, Bangalore 560001. Telephone: 22959343 |

| 1st floor, B M Complex, Mustandra Road, Opp. Dharmarayaswamy Temple, Varthur, Bangalore 560087. Telephone: 22959198 | No.11, I Main Road, Guttahalli, Bangalore 560003. Telephone: 22959357 | No.4, Survey No. 33/4A, B H Road, Dasanapura Dakhle, Devannapalya, Bangalore North Taluka. Telephone: 22959326 | |

| No.46, Next to Anjan Theatre, Magadi Road, Kempapura Agrahara, Bangalore 560023. Telephone: 22959367 | No.111, 9th Main Road, 3rd stage, Pillanna Garden, Kacharakanahalli, Bangalore 560045. Telephone: 22959321 | H C Puttaswamy Layout, Hesaraghatta, Bangalore North Taluk. Bangalore 560088. Telephone: 28466100 | Bangalore South Taluka, APCM Society, Kanakapura Road, Banashankari, Bangalore 560070. Telephone: 22959331 |

| NH-7, Opp. Police Station, Bellary Road, Bangalore North Taluk. Bangalore 562157. Telephone: 28467474 | No.1943, Tavarekere Kengeri Road, Tavarekere, Bangalore 562130. Telephone: 28430714 | ||

| No.70, 5th Main, Ganganagar, Bangalore 560 032. Telephone: 22959359 | No.430, Anna Building, Bommasandra Industrial Area, Hennagara Gate, Hosur Main Road, Attibele, Bangalore 560099. Telephone: 27836583 | ||

| No.51/C, 3rd Main Road, Lorry Stand Godown Layout, APMC Yard, Yeshwanthpur, Bangalore 560022. Telephone: 22959366 | No 459/39/2, Bannerghatta Village, Opp. Police Station, Bannerghatta, Bangalore 560083. Telephone: 27828207 | ||

| No.167-168, B T M Layout I Stage, Tavarekere Main Road, Bangalore 560076. Telephone: 22959360 | No.2255, Karuna Complex, Sahakara Nagara, Rajarajeshwari Road, Bangalore 560092. Telephone: 22959341 | ||

| No.50/1. Church Street, Bangalore 560001. Telephone: 22959354 |

Registration Offices in Bengaluru-Rural (Zone-wise)

| Bengaluru East | Bengaluru North | Bengaluru South |

|---|---|---|

| Mini Vidhana Soudha, Hoskote, Bangalore Rural District 561203. Telephone: 27934525 | Taluk Office Premises. Devanahalli, Bangalore Rural District 562110. Telephone: 27681021 | Mini Vidhana Soudha Building, Magadi, Bangalore Rural District 562120. Telephone: 27746750 |

| Mini Vidhana Soudha Taluk Office, Doddabllapura, Bangalore Rural District 561203. Telephone: 27626876 | Taluk Office Premises, Mini Vidhana Soudha Building, Kanakapura, Ramanagar District 571511. Telephone: 27255412 | |

| Mini Vidhana Soudha Building, Nelamangala, Bangalore Rural District 562123. Telephone: 27724110 | Taluk Office Premises, Old B M Road, Ramanagar, Bangalore Rural District 571511. Telephone: 27276270 | |

| Taluk Office Premises, B M Road, Channapatna. Bangalore Rural District 571501. Telephone: 27255412 |

EC and CC Fee in Bangalore

Encumbrance Certificate (EC) Fee

| Particulars | Fee |

|---|---|

| General Search for First Year | Rs 35 |

| For Every Other Year | Rs 10 |

Certified Copy (CC) Fee

| Particulars | Fee |

|---|---|

| Single Search Fee | Rs 25 |

| Copying Fee for Every 100 Words | Rs 5 |

| For Computer Registered Docs per Page | Rs 10 |

How to Apply for a Stamp Duty Refund in Bangalore?

Stamp duty value varies across states, and the process to apply for a stamp duty refund is also different. If the prospective buyer submits an application for a refund by providing documents, they will get a stamp duty refund of 98%. However, an application for a refund in stamp duty must be deposited by the buyer.

Documents Required for Stamp Duty Refund

- Original sale document containing agreement details

- Original cancellation deed of the property that was going to be purchased

Conclusion

For those planning to invest in property in Bangalore, it is crucial to know the latest guidance value in advance. This will impact the stamp duty they will have to pay. Note that the value for all buyer categories, including male, female, and joint (male and female), will be the same. Understanding the guidance value can help you make informed decisions and avoid any legal or financial pitfalls.