E-Stamping in India: A Comprehensive Guide

For the registration of all deeds related to the change of ownership in property documents, the person concerned must pay stamp duty to the state government through the sub-registrar office (SRO). In India, this duty is traditionally paid through the purchase of physical stamp papers. However, with the advent of technology, various states have introduced e-stamping, a virtual method of paying stamp duty.

What is E-Stamping?

E-stamping is an online method of paying non-judicial stamp duty to a state government. This computer-based application serves as a secure electronic way of stamping documents, eliminating the need for physical stamp papers. These charges apply to deed registrations of all kinds, including rent, lease, sale, gift, will, and relinquishment. Although e-stamping is not yet available nationwide, several states in India have adopted this facility.

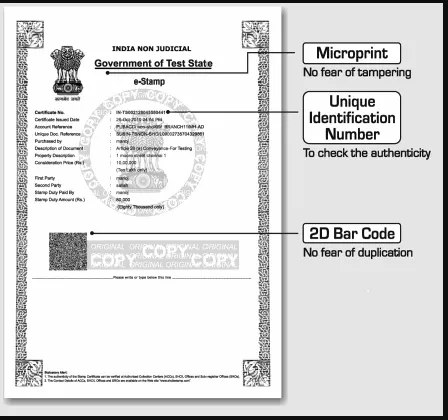

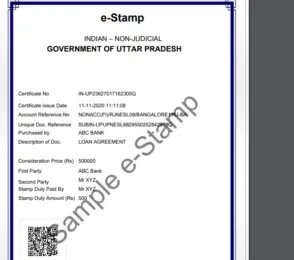

What is an E-Stamp?

An e-stamp is a digital version of a traditional stamp paper. When the entire process of purchasing the stamp paper is conducted online, and no physical stamp paper is involved, the stamp is known as an e-stamp.

Courtesy: Be money aware website

Launch of E-Stamping in India

In July 2013, the government introduced the e-stamping facility through the Stock Holding Corporation of India Limited (SHCIL) to reduce instances of counterfeits and errors. SHCIL serves as the Central Record Keeping Agency (CRA) for all e-stamps used in the country. From user registration to administration, and from applications for e-stamping to maintaining these records, SHCIL is the authority. It also has authorized collection centers (ACCs), which act as intermediaries between SHCIL and the stamp duty payer. Scheduled banks and post offices can become ACCs in India.

States with E-Stamping Facility

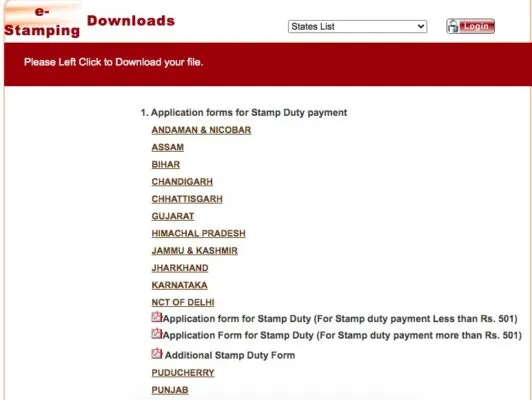

SHCIL provides e-stamping services to 22 states, including:

- Andaman and Nicobar Islands

- Andhra Pradesh

- Assam

- Bihar

- Chhattisgarh

- Chandigarh

- Dadra and Nagar Haveli

- Daman and Diu

- Delhi

- Gujarat

- Himachal Pradesh

- Jammu and Kashmir

- Jharkhand

- Karnataka

- Odisha

- Puducherry

- Punjab

- Rajasthan

- Tamil Nadu

- Tripura

- Uttar Pradesh

- Uttarakhand

Modes of Payment for E-Stamping

Clients can pay the stamp duty amount through various modes, including:

- Cash

- Cheque

- Demand draft

- Pay order

- RTGS

- NEFT

- Account to account transfer

How to Get Your Documents E-Stamped?

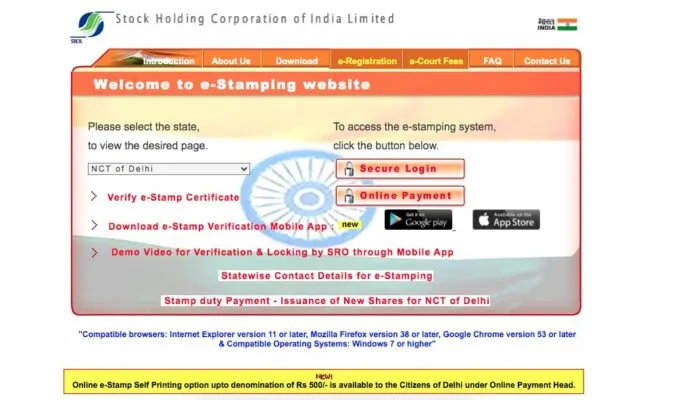

Step 1: Visit the SHCIL Website

Visit the official website of SHCIL at https://www.stockholding.com/. Click on ‘products and services’, choose ‘e-Stamp services’, and finally select ‘e-Stamping’.

If your state allows the e-stamping facility, it will show on the website.

Step 2: Select the State

Select the state from the dropdown list. For example, choose NCT of Delhi.

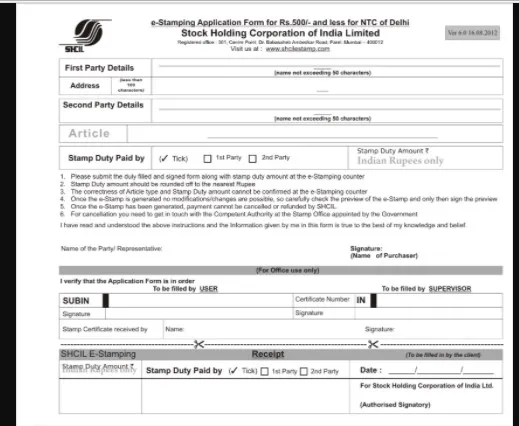

Step 3: Fill an Application

On the homepage, go to the ‘Downloads’ tab and select the required application. For instance, if the stamp duty payment is less than Rs 501, download the form and fill it.

Step 4: Submit the Form

Submit the form along with the payment to receive the stamp certificate.

How to Pay Stamp Duty Online for E-Stamping?

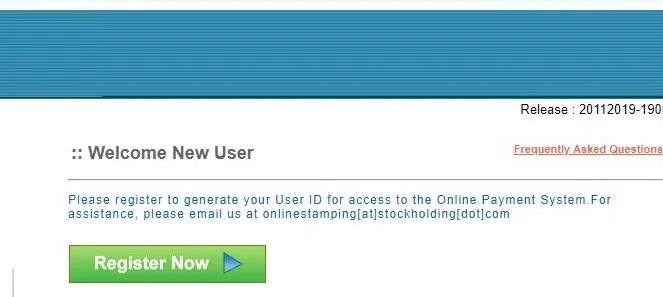

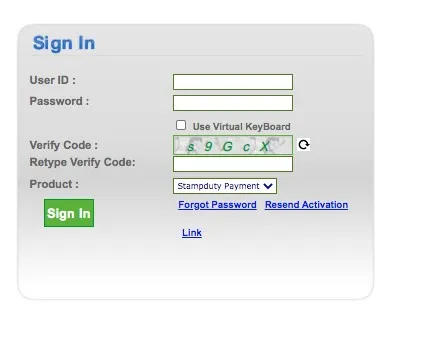

Step 1: Register on SHCIL

New users can click on ‘Register Now’ to proceed.

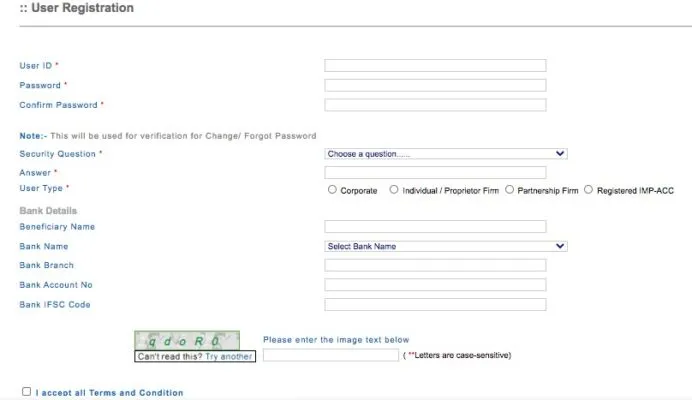

Step 2: Fill in Required Information

Fill in the required information, choose a User ID, password, security question, and provide your bank account details.

Step 3: Confirm Registration

Upon confirmation through an activation link sent to your registered email address, use your User ID and password to access the services.

Step 4: Login to the Online Module

Login using your activated User ID and password.

Step 5: Select the State

Select the state (e.g., ‘Delhi’) from the drop-down menu. Then select ‘Nearest SHCIL Branch’ and provide mandatory details like First Party Name, Second Party Name, Article No, Stamp Duty Paid By, and Stamp Duty Amount to generate an Online Reference Acknowledgement No. for payment through Net Banking/Debit Card/NEFT/RTGS/FT.

Step 6: Print the E-Stamp Certificate

Carry a printout of the Online Reference Acknowledgement No. and visit the nearest Stock Holding Branch to take a final printout of the e-stamp certificate.

Note: Citizens have to bear the actual bank and payment gateway charges.

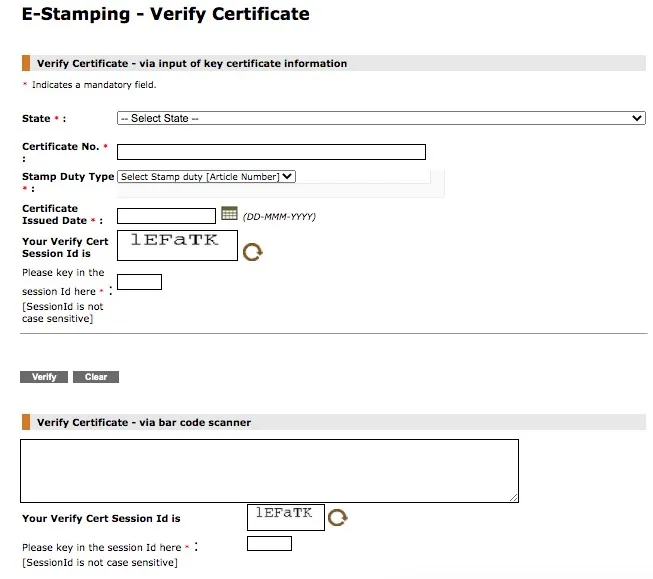

How to Verify an E-Stamp?

On the homepage, find the option called ‘Verify e-stamp’. Click on it to continue. Enter the state, certificate number, type of stamp duty, date of issuance, and session ID, then click on ‘Verify’.

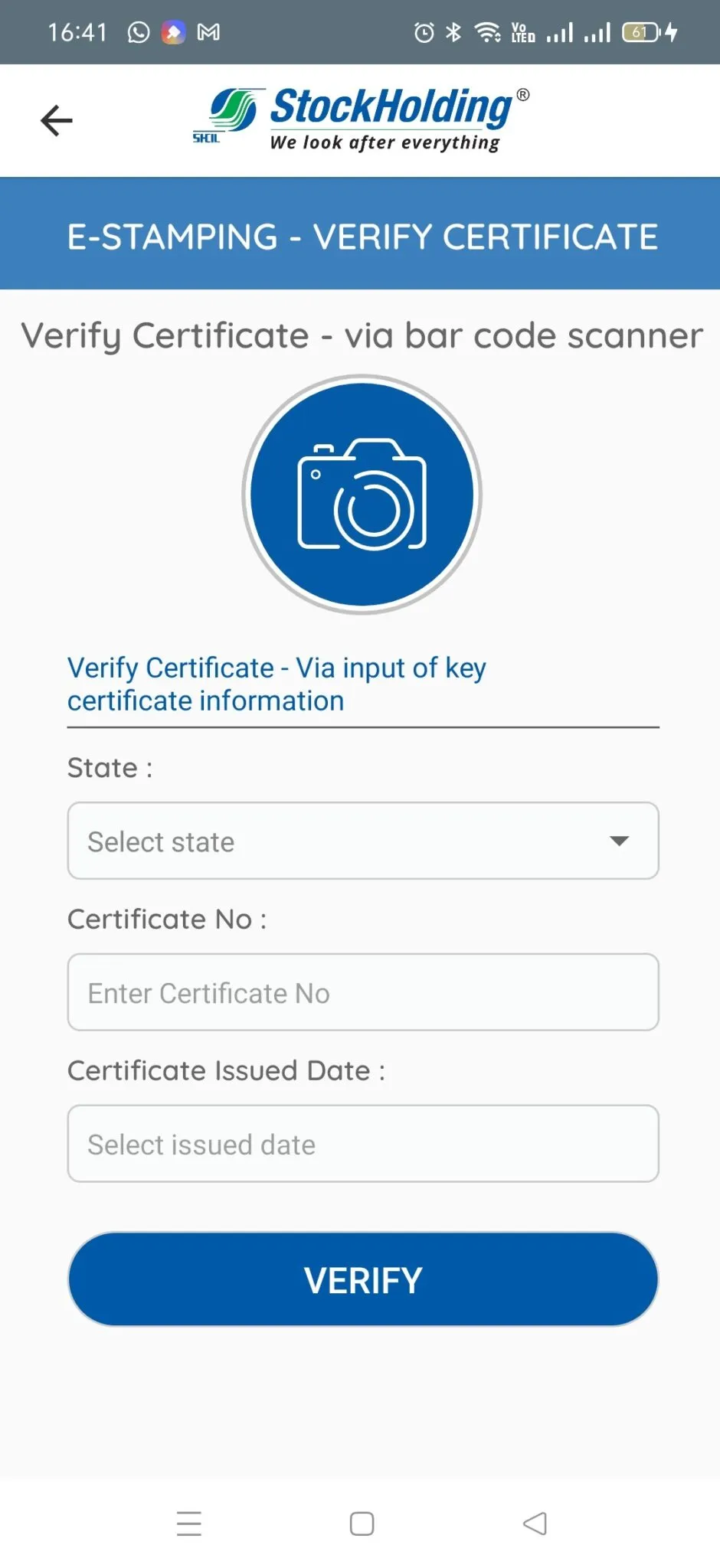

How to Verify an E-Stamp Using a Mobile App?

Download the e-Stamp verification mobile app from Google Playstore or the AppStore. You can scan or manually verify the e-Stamp.

For scanning, scan the QR code on the certificate to access all the details. Note that the scan option will not work for e-Stamp certificates generated before February 13, 2019.

To manually verify, click on the manual button. Select the state from the drop-down box, enter the certificate number and issued date, then click on ‘Verify’.

You will get all the details, including the certificate number, issued date, amount reference, unique doc reference, purchased by, description of the document, consideration price, first party, second party, stamp duty paid by, and the stamp duty amount.

How to Generate a Duplicate Copy if an E-Stamp is Lost?

You can re-generate the lost e-stamp by providing the following details on the official SHCIL website:

Benefits of E-Stamping

Highly Efficient

With e-stamping, the e-stamp certificate can be generated in a few minutes, saving a great deal of time and energy.

Higher Security

An e-stamp cannot be tampered with since it has a unique identification number (UIN).

Easy Verification

Using the inquiry module, you can verify the genuineness of an e-stamp certificate.

Flexibility

Unlike traditional stamps, an e-stamp does not carry a specific denomination, making it a more flexible option.

No Duplicate Copy Available

A duplicate copy of an e-stamp certificate will not be issued, curbing any chances of tampering.

Physical Visit for Refund

You can get a refund for an e-stamp request once it is canceled, only when you approach an SHCIL office. This plugs a big loophole and lowers the chances of wrongful refunds.

When is E-Stamping Used by Businesses?

Businesses across various sectors utilize e-stamping for numerous purposes, such as:

- Loan or finance agreements

- Certifying the legality of official contracts

- Property purchase and sale transactions

- Vendor onboarding processes

- Lease agreements

- Human resource (HR) activities

- Affidavits

- Sale deeds

- Other business agreements

E-Stamping: Things to Keep in Mind

Safeguard Your Verification Certificate

Keep a copy of your verification certificate safe, as duplicate copies will not be issued. Ensure you have a backup in case the original document is lost or misplaced.

Refund Process

To apply for a refund on a canceled e-stamp, you must visit the Stock Holding Corporation of India office.

Payment Methods in Maharashtra

In Maharashtra, e-stamp fees can only be paid online.

Alternative Payment Method

The ‘Electronic Secured Bank Treasury Receipt’ (e-SBTR) is a secure and reliable online payment method for e-stamping, ensuring timely payment of e-stamp charges.

Conclusion

E-stamping has revolutionized the process of paying non-judicial stamp duty in India, offering a convenient, secure, and efficient alternative to traditional physical stamp papers. It aims to reduce instances of counterfeiting and streamline the documentation process for various transactions. The system is operational in 22 states, with SHCIL serving as the Central Record Keeping Agency. The e-stamp certificate can be generated quickly and is resistant to tampering, ensuring a higher degree of reliability. Overall, e-stamping is a significant advancement in the realm of legal and financial documentation in India, making the process more streamlined and secure for individuals and businesses alike.

(With additional inputs by Dhwani Meharchandani)

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Rajat Piplewar at rajat@bhume.in |