TNReginet: Your Comprehensive Guide to Tamil Nadu’s Registration Portal

TNReginet is the official portal of the Tamil Nadu Registration Department, designed to streamline various registration processes for the state’s citizens. From birth and marriage registrations to land and property transactions, TNReginet offers a plethora of services to make life easier. Let’s dive into the details of what TNReginet has to offer and how you can make the most of it.

What is TNReginet?

TNReginet is an online portal managed by the Tamil Nadu Registration Department. It aims to simplify the registration process for various documents, including birth, marriage, death, and chit fund registrations. Additionally, it serves as a repository for land and property transaction and ownership-related information. The portal is overseen by the Inspector-General of Registration (IGR), who ensures the smooth functioning of all services offered.

Services Offered by TNReginet

The TNReginet portal provides a wide range of services, making it a one-stop solution for various registration needs. Here are some of the key services you can avail of:

- Tamil Nadu TNReginet guideline value search

- Online application for TNReginet EC (Encumbrance Certificate)

- Online EC view

- Online status for EC

- Marriage registration

- Online marriage certificate application

- Birth registration

- Death registration

- Land registration

- Firm registration

- Chit fund registration

- Application for society certification

- Online document registration

- Online document status check

- Calculating building value

- Online certified documents check

- Society search

- Stamp vendor search

- Document writer search

- Stamp duty rates and calculation

- Registered property search

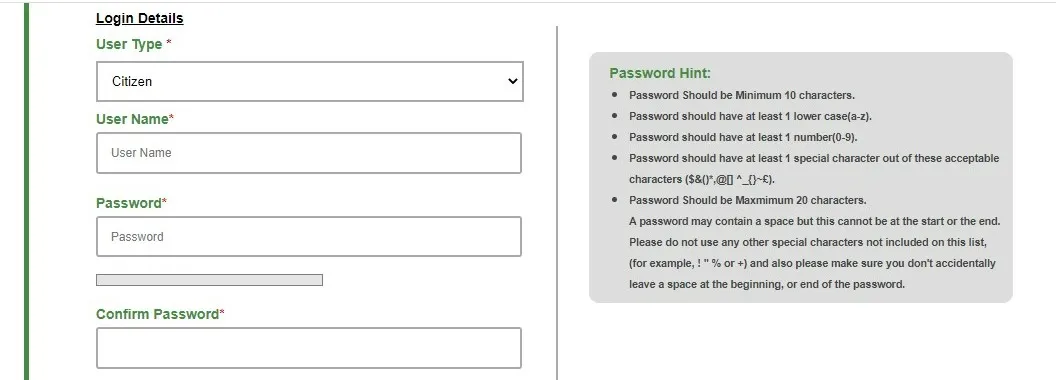

How to Register on TNReginet

To access the services offered by TNReginet, you need to register on the portal. Follow these steps for user registration:

Step 1: Visit the TNReginet Portal

On the TNReginet web portal, click on the ‘Registration’ option.

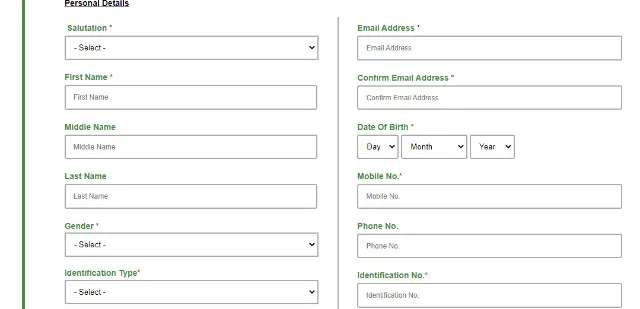

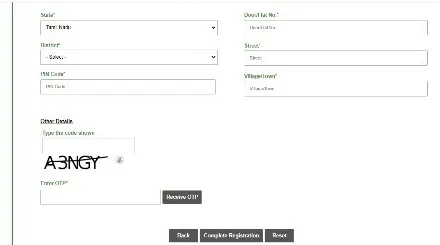

Step 2: Fill in the Registration Form

Key in all the details in the user registration form and hit the ‘Complete Registration’ button.

Important Note

New users must avail of any one of the registered user’s services on TNReginet within seven days from the date of creation of the user profile. Otherwise, their user ID will be deactivated automatically. Existing users must avail of any one of the registered user’s services every three months from the date of the last activity on TNReginet. Otherwise, their user ID will be deactivated automatically.

How to Register a Document on TNReginet

Once you are registered, you can proceed to register documents online. Here’s how:

Step 1: Log In

Using your credentials, log in to the portal.

Step 2: Create Document Online

Under the Registration option, go to Document Registration and then click on Create Document Online option.

Step 3: Select Document Type

Select the document type from the dropdown menu.

Step 4: Enter Details

Enter all the required party details and witness details. Identification type for all applicable parties, representatives, and execution witnesses is mandatory.

Step 5: Capture Photo and Biometric Data

Go to My Documents, select the document, and click on the photo biometric capture to capture the photo and validate Aadhaar for all applicable parties.

Step 6: Make Payment

Once the document is created, upload the required reference document and make the payment.

Step 7: Submit

After successful payment, the document will be moved to the SRO Queue in the Back Office.

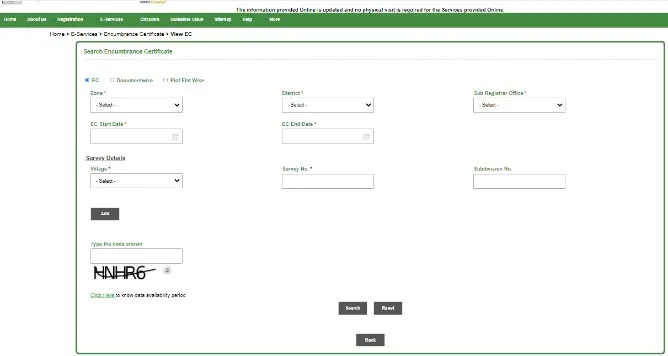

How to Check the Status of Property or Land Online (EC Status)

To check the status of your property or land, follow these steps:

Step 1: Visit the TNReginet Portal

On the TNReginet portal, click on the option ‘E-Services’.

Step 2: View EC

When you reach the ‘Encumbrance Certificate’ option, click on ‘View EC’.

Step 3: Fill in Details

The TNReginet portal will display the ‘Search Encumbrance Certificate’ screen. Fill in all the details to proceed with the TNReginet online EC search.

Step 4: Search

Fill in the zone, district, EC start date, and survey details, and click the ‘Add’ button. Enter the captcha code and click ‘Search’.

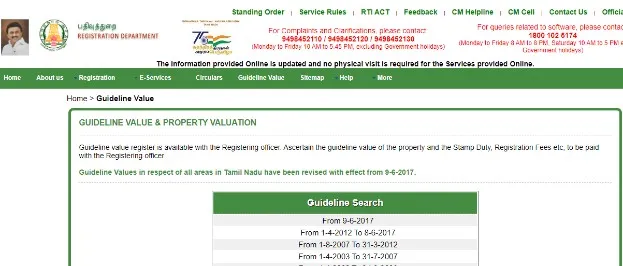

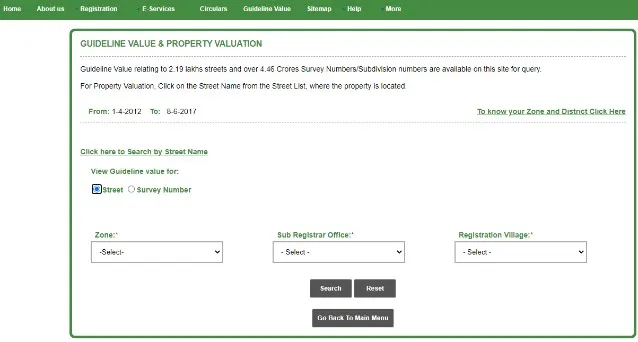

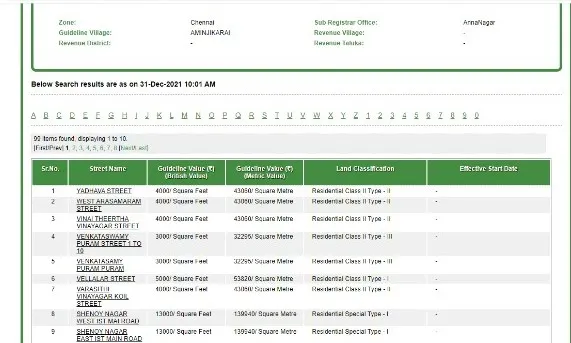

TNReginet Guideline Value

The TNReginet guideline value is the minimum price at which land and property can be registered in Tamil Nadu. This value is revised periodically to align with market rates.

Steps to Check Guideline Value

Step 1: Visit the TNReginet Portal

Go to the TNReginet portal and click on ‘Guideline Value’ on the home page.

Step 2: Select Period

The next page will display the guideline value of property in Tamil Nadu, starting from the year 2002 till 2017.

Step 3: Fill in Details

Select the period for which you want to check the TNReginet guideline value. Fill in all the required details and hit ‘Search’.

Step 4: View Results

Your search result will display the Tamil Nadu guideline value for every street, based on the selected zone and registration details.

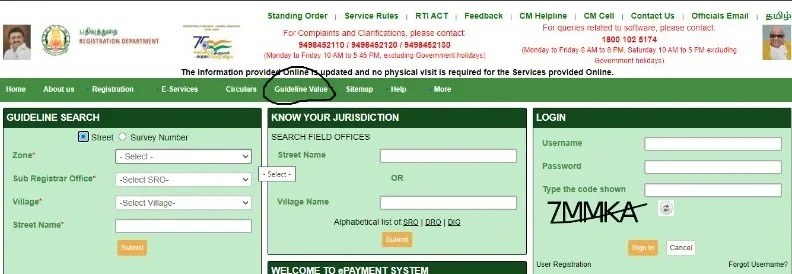

TNReginet: Jurisdiction Check Process

To find out the local jurisdiction of your area, follow these steps:

Step 1: Visit the TNReginet Portal

On the TNReginet homepage, go to the ‘Know your Jurisdiction’ option.

Step 2: Fill in Details

Fill in the street name or village name, and hit ‘Submit’.

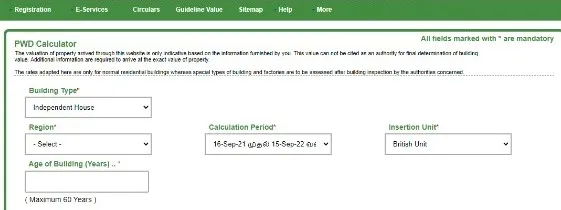

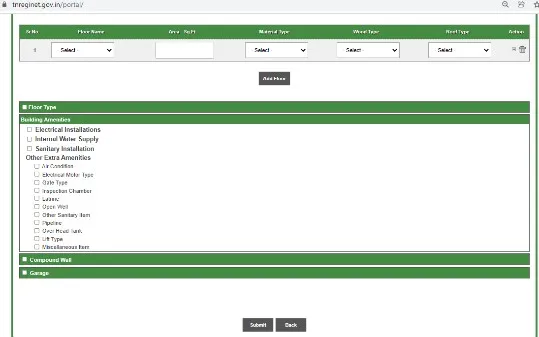

TNReginet: Building Value Calculation

To calculate the property value for stamp duty and registration charge payment, follow these steps:

Step 1: Visit the TNReginet Portal

On the TNReginet home screen, click on the ‘Building value calculation’ option at the bottom of the page.

Step 2: Fill in Details

Fill in all the details in the form to know your building value.

Tamil Nadu Stamp Duty and Registration Charges in 2024

Understanding the stamp duty and registration charges is crucial for any property transaction. Here’s a detailed table of the charges:

| Category of Document | Stamp Duty | Registration Fee |

|---|---|---|

| Sale deed | 7% on the market value of the property | 4% on the market value of property |

| Gift deed | 7% on the market value of the property | 4% on the market value of the property |

| Exchange deed | 7% on the market value of the greater value | 4% on the market value of the greater value |

| Simple mortgage deed | 1% (on the loan amount) subject to a maximum of Rs 40,000 | 1% on loan amount subject to a maximum of Rs 10,000 |

| Mortgage with possession deed | 4% on loan amount | 1% subject to the maximum of Rs 2,00,000 |

| Agreement to sale | Rs 20 | 1% on the money advanced (1% on total consideration if possession is given) |

| Agreement relating to construction of a building | 1% on the cost of the proposed construction or the value of construction or the consideration specified in the agreement, whichever is higher | 1% on the cost of the proposed construction or the value of construction or the consideration specified in the agreement, whichever is higher |

| Cancellation deed | Rs 50 | Rs 50 |

| Partition deed | ||

| I) Partition among family members | 1% on the market value of the property subject to a maximum of Rs 25,000 for each share | 1% subject to a maximum of Rs 4,000 for each share. |

| II) Partition among non-family members | 4% on the market value of the property for separated shares | 1% on the market value of the property for separated shares |

| Power of attorney | ||

| I) General power of attorney to sell an immovable property | Rs 100 | Rs 10,000 |

| II) General power of attorney to sell an immovable property (Power is given to a family member) | Rs 100 | Rs 1,000 |

| III) General power of attorney to sell the movable property & for other purposes | Rs 100 | Rs 50 |

| IV) General power of attorney given for consideration | 4% on consideration | 1% on consideration or Rs 10,000, whichever is higher |

| Settlement deed | ||

| I) In favour of family members | 1% on the market value of the property but not exceeding Rs 25,000 | 1% on the market value of the property, subject to a maximum of Rs 4,000/- |

| II) Other cases | 7% on the market value of the property | 4% on the market value of the property |

| Partnership deed | ||

| I) Where the capital doesn’t exceed Rs 500 | Rs 50 | 1% on the capital invested |

| II) Other cases | Rs 300 | 1% on the capital invested |

| Memorandum of deposit of title deeds | 0.5% on the loan amount, subject to a maximum of Rs 30,000 | 1% on the loan amount, subject to a maximum of Rs 6,000 |

| Release deed | ||

| I) Release among family members (coparceners) | 1% on the market value of the property, but not exceeding Rs 25,000 | 1% on the market value of the property, subject to a maximum of Rs 4,000 |

| II) Release among non-family members (co-owner and benami release) | 7% on the market value of the property | 1% on the market value of the property |

| Lease | ||

| Lease below 30 years | 1% on the total amount of rent, premium, fine, etc. | 1%, subject to a maximum of Rs 20,000 |

| Lease up to 99 years | 4% on the total amount of rent, premium, fine, etc. | 1%, subject to a maximum of Rs 20,000 |

| Lease above 99 years or perpetual lease | 7% on the total amount of rent, fine, premium of advance, if any | 1%, subject to a maximum of Rs 20,000 |

| Declaration of trust (if a property is there, it would be considered as a sale) | Rs 180 |

Source: TNReginet

Conclusion

TNReginet is a powerful tool for residents of Tamil Nadu, offering a wide range of services to simplify various registration processes. Whether you need to register a birth, marriage, or property, TNReginet has got you covered. By following the steps outlined in this guide, you can easily navigate the portal and make the most of its features. So, go ahead and explore TNReginet to make your registration tasks hassle-free!