Understanding Rent Receipt Format and Revenue Stamps

If you’re planning to claim tax deductions on the house rent allowance (HRA) component of your salary, you’ll need to submit rent receipts to your employer as proof of rent payment. But did you know that affixing a revenue stamp on your rent receipt can make it legally valid under the Indian Stamps Act, 1899? Let’s dive into the details to understand the legal implications and whether affixing a revenue stamp is a must for tenants.

What Are Revenue Stamps?

According to the Indian Stamp Act, 1899, a ‘stamp’ refers to any mark, seal, or endorsement by an authorized agency or person, including adhesive or impressed stamps, for the purpose of duty chargeable under the Act.

Purpose of Revenue Stamps

Revenue stamps are issued by the government to collect taxes for certain services. They look similar to postage stamps and are used in documents like cash receipts, tax payment acknowledgments, and rent receipts. They also help collect fees or revenue for maintaining courts.

According to Maharashtracivilservice.Org, “For every legally permitted transaction, a certain amount of revenue is needed to be given to the government. Stamping of receipts or main documents evidencing giving and taking of money also need such revenue, and the revenue stamp is affixed in proof of that.”

A properly stamped receipt gets a prima facie priority as an acceptable legal proof over a plain paper receipt. In case of a dispute, a stamped rent receipt can be produced as the prime proof of the money being given and received.

When Is a Revenue Stamp Needed?

A revenue stamp must be affixed when there is a receipt, including notes, memorandums, or writings such as:

- Receipt of money, a bill of exchange, cheque, or promissory note.

- Acknowledgment of movable property received in satisfaction of a debt.

- Acknowledgment for debt or demand, or any part of a debt or demand that has been satisfied or discharged.

When Is a Revenue Stamp Not Needed?

You don’t need to affix a revenue stamp if your monthly rent is below Rs 5,000. Additionally, if you pay rent using online channels and provide your bank statement as proof, you won’t need to generate a rent receipt or affix a revenue stamp.

How to Buy Revenue Stamps

Revenue stamps can be purchased from local post offices or authorized stamp vendors. Each stamp costs Re 1. Some local shops and online shopping portals also sell revenue stamps, often at a higher price. It’s advisable to buy them from post offices or authorized vendors to avoid fake stamps.

Is a Revenue Stamp Needed for Rent Receipts?

If your monthly rent is below Rs 5,000, you don’t need a revenue stamp, even if the rent is paid in cash. However, if the monthly rent paid in cash exceeds Rs 5,000, it’s mandatory to affix a revenue stamp on the rent receipt and get it signed by the landlord. If the rent is paid by cheque, no revenue stamp is needed.

Revenue Stamp on Rent Receipt

To claim the HRA benefit from your employer, you must provide confirmation of rent payment. This confirmation comes in the form of a rent receipt from your landlord. If the rent is paid online or through a cheque, no revenue stamp is needed. However, for cash payments, a rent receipt affixed with a revenue stamp serves as documentary evidence of the transaction. In case of a legal dispute, the rent receipt can be produced as evidence in court.

Value of Revenue Stamp on Rent Receipt

According to the amendment of Schedule-I to the Indian Stamp Act, 1899, you need to affix a revenue stamp of Re 1 on rent receipts where cash payments exceed Rs 5,000.

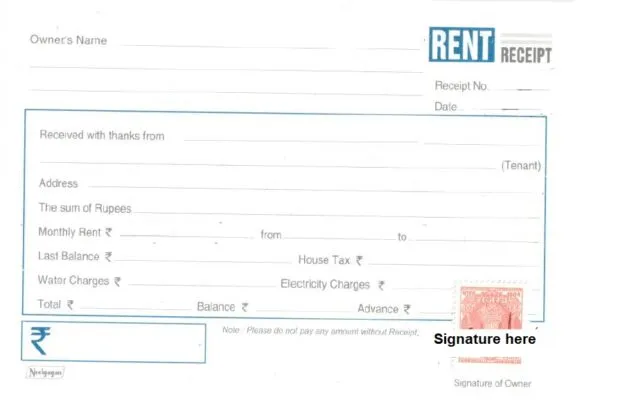

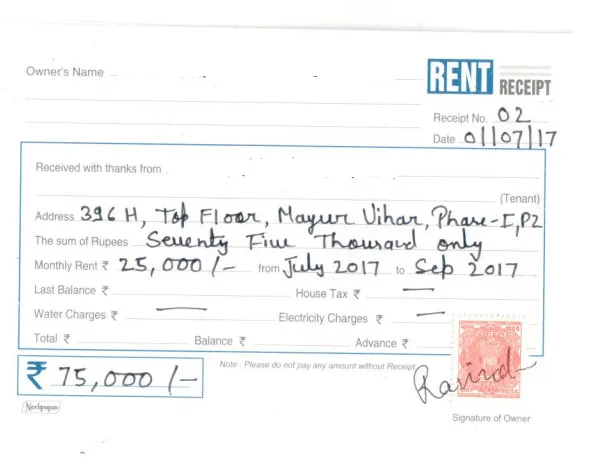

Rent Receipt Format (Filled)

Rs 1 Revenue Stamp for Rent Receipt

Components of a Rent Receipt with Revenue Stamp

A rent receipt for cash payments becomes valid when affixed with a revenue stamp and includes the following information:

- Name of the tenant

- Name of the landlord

- Address of the rental property

- Rent amount

- Rental period

- Mode of payment – cash/online/cheque

- Signature of the landlord

- If the annual rent exceeds Rs 1 lakh, the landlord’s PAN number should be included.

- Details of other charges such as water bills, electricity charges, etc.

- Revenue stamp if cash payment exceeds Rs 5,000.

BhuMe.in Viewpoint

If you fail to submit your rent receipts with revenue stamps, your employer will not accept them as proof of rent payment, and you may face penalties. If a payee refuses to give a receipt with a revenue stamp, they can be fined Rs 100 under Section 65 of the Stamps Act.

Got any questions or points of view on our article? We would love to hear from you. Write to our Editor-in-Chief Rajat Piplewar at [email protected].