Pradhan Mantri Awas Yojana (PMAY): A Comprehensive Guide

The Pradhan Mantri Awas Yojana (PMAY) aims to eliminate India’s housing shortage by focusing on both urban and rural areas under the government’s broader housing-for-all mission. Launched on June 1, 2015, the program follows a demand-driven approach where states identify eligible beneficiaries through a demand survey based on specific criteria.

PMAY: Key Highlights

| PMAY Full Form | Pradhan Mantri Awas Yojana |

|---|---|

| PMAY Verticals | PMAY-Urban (PMAY-Shahri), PMAY-Rural (PMAY-Gramin) |

| Official Website | PMAY Urban: https://pmaymis.gov.in/, PMAY Rural: http://iay.nic.in/ |

| Launch Date | June 25, 2015 |

| Valid Till | PMAY-Urban: December 31, 2024, PMAY-Gramin: March 31, 2024 |

| Address | Pradhan Mantri Awas Yojana (Urban), Ministry of Housing and Urban Affairs, Nirman Bhawan, New Delhi-110011 |

| PMAY Components | In-Situ Slum Redevelopment, Credit Linked Subsidy Scheme, Affordable Housing in Partnership, Beneficiary-led Construction Scheme |

| Toll-Free Number | 1800-11-6163 – HUDCO, 1800 11 3377, 1800 11 3388 – NHB |

PMAY Categories

The scheme has two main components:

- PMAY-Urban, also known as Pradhan Mantri Awas Yojana-Shahri

- PMAY-Rural, also known as Pradhan Mantri Awas Yojana-Gramin

PMAY-Gramin or PMAY-Rural

To address the housing shortage in rural areas, the government restructured the Indira Awas Yojana (IAY) into the Pradhan Mantri Awas Yojana-Gramin (PMAY-G) effective from April 1, 2016. The PMAY-G program aims to replace kuccha homes in India’s villages with pucca homes. As of February 1, 2024, over 2.55 crore houses have been completed under PMAY-G. The Ministry of Rural Development aims to construct 2.95 crore pucca houses with basic amenities by March 2024.

PMAY-Urban or PMAY-Shahri

Launched on June 25, 2015, the PMAY Urban mission aims to end housing shortages in India’s urban areas. The government plans to build 20 million homes under the PMAY-U mission. The urban scheme has been extended till December 31, 2024. As of August 31, 1.19 crore homes have been sanctioned under PMAY-U, with 76.34 lakh units completed and delivered to beneficiaries.

Verticals of PMAY

The PMAY is divided into four verticals:

In-Situ Slum Redevelopment (ISSR)

This vertical focuses on the rehabilitation of slums by building houses through private participation for eligible slum dwellers on the land under the slums.

Credit-Linked Subsidy Scheme (CLSS)

This scheme provides central subsidies on home loans between Rs 6 lakhs and Rs 12 lakhs at lower interest rates for constructing new homes or renovating existing ones.

Affordable Housing in Partnership (AHP)

States build affordable housing projects with central assistance of Rs 1,50,000, either through central agencies or in partnership with the private sector for the EWS category.

Beneficiary-Led Individual House Construction/Enhancements (BLC)

This vertical allows people belonging to the EWS category to either construct a new house or enhance the existing house on their own with central assistance of Rs 1,50,000.

PMAY Credit-Linked Subsidy Scheme (CLSS)

Under the CLSS, borrowers can get a certain amount from their overall home loan at subsidized rates, depending on the buyer category they fall into.

Pradhan Mantri Awas Yojana: Beneficiary Categories

Beneficiaries under the PMAY list are divided into four categories based on the annual income of the household:

| Beneficiary | Annual Income of the Household |

|---|---|

| Economically Weaker Section (EWS) | Up to Rs 3 lakh |

| Lower Income Group (LIG) | Rs 3 lakh to Rs 6 lakh |

| Middle Income Group-1 (MIG-1) | Rs 6 lakh to Rs 12 lakh |

| Middle Income Group-2 (MIG-2) | Rs 12 lakh to Rs 18 lakh |

PMAY Beneficiary Eligibility

Family Status

A family of husband, wife, and unmarried children is considered a household. A beneficiary applying for benefits under this scheme should not own a pucca house in any part of India.

Home Ownership

People with a pucca house of less than 21 sq meters may be included under the enhancement of the existing house.

Age

Adult earning members of a family are considered a separate household and thus, a beneficiary of the scheme, irrespective of their marital status.

Marital Status

In the case of married couples, either of the spouses or both together in joint ownership will be eligible for a single house, provided they meet the income eligibility criteria of the household under the scheme.

Category

Beneficiaries from the EWS category are eligible for assistance in all four verticals of the missions, whereas the LIG/MIG category is eligible under only the CLSS component. People belonging to the SC, ST, and OBC categories and women belonging to the EWS and LIG are also eligible to avail of benefits under the Pradhan Mantri Awas Yojana.

Carpet Area Limit Under PMAY

| Category of Applicant | Annual Income in Rs | House Carpet Area in sqm | House Carpet Area in sqft |

|---|---|---|---|

| EWS | 3 lakh | 60 | 645.83 |

| LIG | 6 lakh | 60 | 645.83 |

| MIG-1 | 6-12 lakh | 160 | 1,722.33 |

| MIG-2 | 12-18 lakh | 200 | 2,152.78 |

PMAY Interest Subsidy Under CLSS

| Buyer Category | Interest Subsidy/Annum | Upper Limit for Loan for Which Subsidy is Given |

|---|---|---|

| EWS | 6.50% | Rs 6 lakh |

| LIG | 6.50% | Rs 6 lakh |

| MIG-1 | 4.00% | Rs 9 lakh |

| MIG-2 | 3.00% | Rs 12 lakh |

Any additional loans beyond the subsidized loan amount will be at non-subsidized rates. The loans should have been used either for the purchase of an under-construction property or from the secondary market or to construct your own home. Under the PMAY guidelines, the house bought by availing of a loan under this scheme should be in the name of the woman of the household for the EWS and LIG categories. Ownership by women is not mandatory if a unit is being developed using a land parcel.

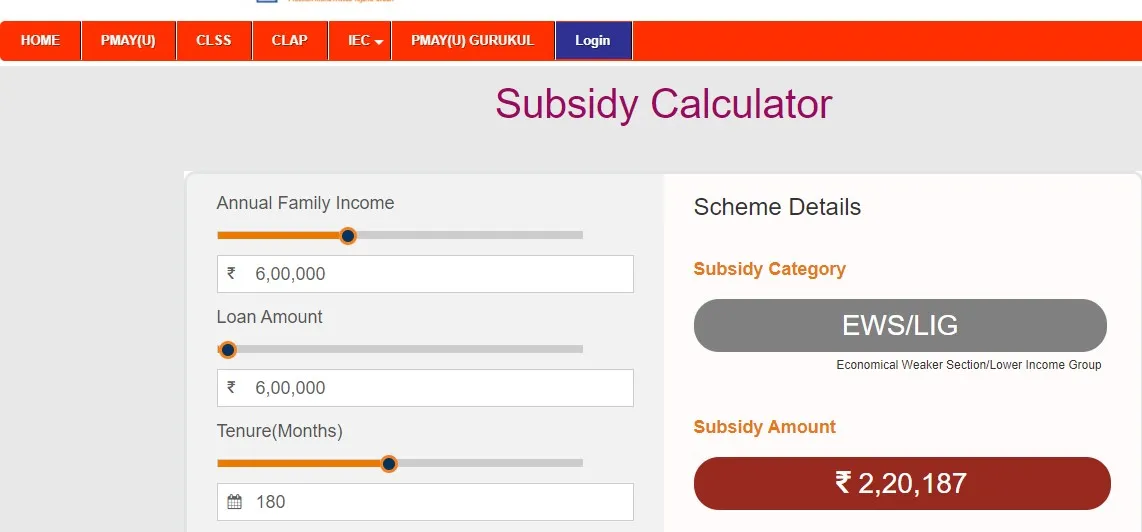

PMAY Subsidy Calculator

Using the PMAY subsidy calculator at the official portal, https://pmayuclap.gov.in/content/html/Subsidy-Calc.html, you can know the exact amount of money you will receive from the government as the subsidy under the CLSS. To calculate the amount, you will have to key in details like your annual income, loan amount, loan tenure, type of units (whether pucca or kuccha), ownership type (women ownership is a must in EWS and LIG homes), and area of the unit. Apart from displaying the subsidy amount, the page will also display the subsidy category, i.e., EWS, LIG, MIG-1, or MIG-2.

Subsidy Amount Under PMAY for Various Categories

| Borrower Category | EWS | LIG | MIG-1 | MIG-2 |

|---|---|---|---|---|

| PMAY CLSS Subsidy Amount | Rs 2.20 lakh | Rs 2.67 lakh | Rs 2.35 lakh | Rs 2.30 lakh |

The maximum subsidy under the PMAY scheme is Rs 2.67 lakh (Rs 2,67,280 to be exact).

PMAY Home Loan Subsidy Benefit Timeline

For the EWS and LIG categories, the subsidy benefit is available on home loans that are disbursed on or after June 17, 2015. In the case of MIG-1 and MIG-2 categories, the subsidy benefit is available on home loans that are disbursed on or after April 1, 2017.

How the Subsidy Under PMAY Reaches You

Once your application for subsidy under the PMAY program is approved, funds are transferred from the central nodal agency (CNA) to the bank (referred to as prime lending institutions or PLI in government documents) from where the beneficiary has borrowed his home loan. The bank will then credit this amount to the home loan account of the borrower. This money will then be deducted from your outstanding home loan principal. So if you have received Rs 2 lakhs as the PMAY subsidy and your outstanding loan amount is Rs 30 lakhs, it would reduce to Rs 28 lakhs after the subsidy.

Helpline Numbers to Inquire About CLSS

- NHB Toll-Free Number: 1800-11-3377, 1800-11-3388

- HUDCO Toll-Free Number: 1800-11-6163

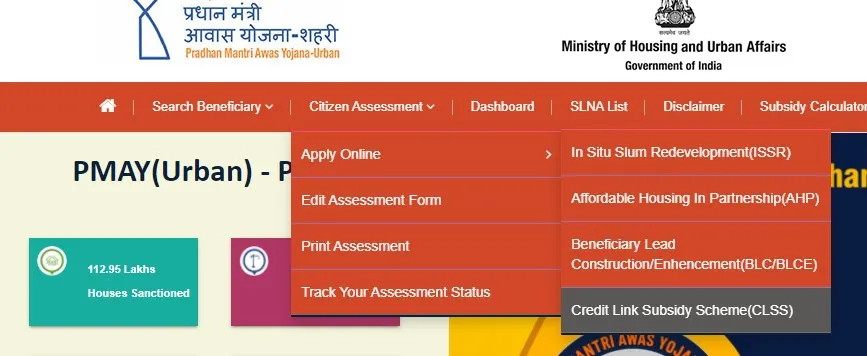

How to Apply for PM Awas Yojana Online in 2024

First of all, remember that only a candidate with an Aadhaar card can apply for the benefits of the PMAY scheme. To apply online, keep your Aadhaar number handy and visit the PMAY portal at https://pmaymis.gov.in. On the homepage, click on the ‘apply online’ option under the ‘citizen assessment’ tab. Now, select one among the four verticals for which you want to apply.

If you are applying for the CLSS subsidy, your application must be submitted to your home loan provider.

How to Apply Offline for PMAY in 2024

Eligible candidates can obtain and fill forms available at common service centers (CSCs). They have to pay a nominal fee of Rs 25 plus GST on the purchase of the PMAY subsidy form. CSCs are the access point to avail of essential public utility services in rural parts of India.

Time Taken to Get Subsidy Amount from PMAY

It takes nearly 3-4 months for an application to be processed.

PMAY Home Loan: Important Points

Aadhaar Must

All home loan accounts under the PMAY scheme will be linked to the Aadhaar numbers of the beneficiary.

Cap on Tenure

The subsidy is available for a maximum tenor of 20 years only.

No Interest Rate Concession

The lender from where you have taken a home loan will charge an interest rate that is prevailing at the bank.

Loan Transfer Caveat

If you switch your lender to avail of benefits of low-interest rates, even though you have already availed of the interest subvention benefit under the CLSS, then, you will not be eligible for the interest subvention benefit again.

How to Check PMAY Subsidy Status

You can check your PMAY application status by following some simple steps. To check your PMAY status online, read our step-by-step guide on How to track your PMAY application status?

How to Download PMAY Application Form

Visit the official website of the PMAY and click on the ‘Citizen Assessment’ option. From the drop-down menu, select ‘Track Your Assessment Status’. Once you click on this option, you will get the Track Assessment Form. Select either ‘By Name, Father’s Name and Mobile Number’ or ‘By Assessment ID’. Enter the required details and click on ‘Submit’ to access the application form. Once the form appears on the screen, click on ‘Print’.

Banks Offering Home Loans Under PMAY

- SBI

- Punjab National Bank

- Bank of Baroda

- HDFC Bank

- ICICI Bank

- Axis Bank

- IDFC First Bank

- Bandhan Bank

- Bank of India

- IDBI Bank

- Canara Bank

Key Facts About PMAY

Full Form of CNAs in PMAY Context

The term CNA stands for central nodal agency. In the case of PMAY, National Housing Bank (NHB), HUDCO, and SBI have been appointed as the central nodal agencies.

Process to Get the Assessment ID for PMAY

The assessment ID for the PMAY is generated by the official PMAY portal after an applicant successfully completes the registration process. This ID is used to track the status of the application.

Banks Eligible to Provide PMAY Home Loan

A large number of banks, housing finance companies, regional rural banks, cooperative banks, and non-banking finance companies (NFCs) have tied up with the central nodal agencies, HUDCO, SBI, and NHB, to offer home loans under various verticals of the PMAY. Formally christened as the primary lending institutions (PLIs) under the official PMAY documentation, these financial institutions, which are as large as 244 in number according to official figures provided in 2017, also offer individual home buyers with the credit-linked subsidy, among other loans under the program. Listed below are the top state-run and private lenders offering credit subsidy on home loans under the PMAY program.

Top Public Banks That Offer PMAY Subsidy

| Bank | Website | Associated Central Nodal Agency |

|---|---|---|

| State Bank of India | www.sbi.co.in | NHB |

| Punjab National Bank | www.pnbindia.in | NHB |

| Allahabad Bank | www.allahabadbank.in | NHB |

| Bank of Baroda | www.bankofbaroda.co.in | NHB |

| Bank of India | www.bankofindia.com | NHB |

| Bank of Maharashtra | www.bankofmaharashtra.in | NHB |

| Canara Bank | www.canarabank.in | NHB |

| Central Bank of India | www.centralbankofindia.co.in | HUDCO |

| Corporation Bank | www.corpbank.com | NHB |

| Dena Bank | www.denabank.co.in | NHB |

| IDBI Bank | www.idbi.com | NHB |

| Indian Bank | www.indian-bank.com | NHB |

| Indian Overseas Bank | www.iob.in | NHB |

| Oriental Bank of Commerce | www.obcindia.co.in | NHB |

| Punjab & Sind Bank | www.psbindia.com | NHB |

| Syndicate Bank | www.syndicatebank.in | NHB |

| UCO Bank | www.ucobank.com | NHB |

| Union Bank of India | www.unionbankonline.co.in | NHB |

| United Bank of India | www.unitedbankofindia.com | NHB |

| Vijaya Bank | www.vijayabank.com | HUDCO |

Top Private Banks That Offer PMAY Subsidy

| Bank | Website | Associated Central Nodal Agency |

|---|---|---|

| Axis Bank | www.axisbank.com | NHB |

| ICICI Bank | www.icicibank.com | NHB |

| HDFC Bank | www.HDFC.com | NHB |

| Kotak Mahindra Bank | www.kotak.com | NHB |

| LIC Housing Finance | www.lichousing.com | NHB |

| Karnataka Bank | www.karnatakabank.com | NHB |

| Karur Vysya Bank | www.kvb.co.in | NHB |

| IDFC Bank | www.idfcbank.com | NHB |

| Jammu & Kashmir Bank | www.jkbank.net | HUDCO |

| Bandhan Bank | www.bandhanbank.com | NHB |

| Dhanlaxmi Bank | www.dhanbank.com | HUDCO |

| Deutsche Bank AG | www.deutschebank.co.in | NHB |

| South Indian Bank | www.southindianbank.com | HUDCO |

| Lakshmi Vilas Bank | www.lvbank.com | NHB |

| Aadhar Housing Finance | www.aadharhousing.com | NHB |

| Aditya Birla Housing Finance | www.adityabirlahomeloans.com | NHB |

| Bajaj Housing Finance | www.bajajfinserv.in | NHB |

| PNB Housing Finance | www.pnbhousing.com | NHB |