Everything You Need to Know About LIC Home Loans

LIC Housing Finance Limited (LIC HFL), a subsidiary of the Life Insurance Corporation (LIC), was established on June 19, 1989. Headquartered in Mumbai, LIC HFL provides long-term financing for individuals looking to purchase or construct homes or flats for residential purposes. Additionally, the company offers loans for purchasing existing properties for business use, constructing clinics, nursing homes, diagnostic centers, office spaces, and housing equipment. In this article, we’ll delve into the various aspects of LIC Housing Finance home loans, including interest rates, services, and how to use the LIC home loan calculator and LIC home loan EMI calculator.

What Are LIC HFL Services?

LIC HFL services make obtaining a housing loan easy and hassle-free. With LIC home loan login services, you can access e-services through the ‘LIC Login Process Online’ without wasting time standing in queues.

How to Do LIC HFL Customer Login

- Visit the LIC HFL website and select the customer portal from the online services or e-services tab.

- If you are new to the website, select the new user button.

- Create a new ‘username’ and ‘password.’

- Login with your new ‘username’ and ‘password’ and click on the submit button.

- You will receive your login information on your registered email or mobile number.

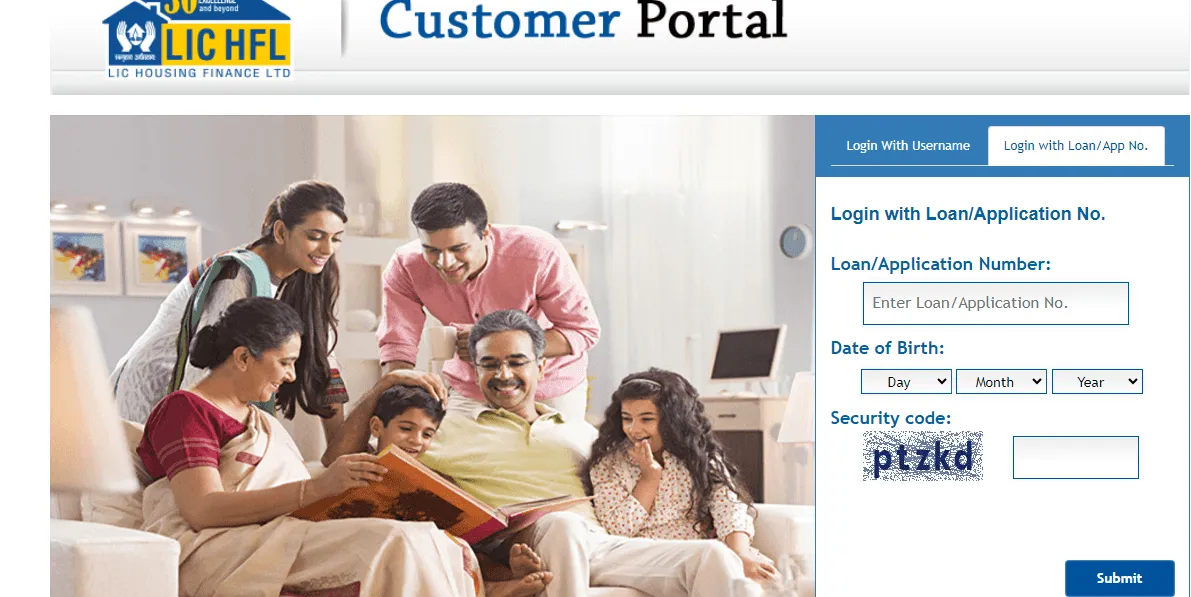

LIC Home Loan Login via Loan Application Number

- Visit the LIC HFL customer portal website.

- Select ‘Login with Loan/App no.’

- Enter your loan/application number and your date of birth.

- Enter the security code in the box.

- Click on Submit.

How to Check the LIC HFL Home Loan Approval Status Online

- Visit the LIC HFL customer portal and log in.

- Click on the Home Loans tab.

- On the next page, click on the Online Loan Application button.

- Select Click to Track Application.

- Enter your application number and click on Submit.

- You can now see your home loan application status.

How to Pay LIC HFL Home Loan EMI Online

- Visit the LIC HFL customer portal and log in.

- Select the ‘pay online’ option.

- Click on ‘loan account’ and ‘Get dues.’

- The amount for the specific loan due date will appear.

- Click on the Pay option.

- Select the mode of communication.

- Choose where you would like to receive your messages, mobile or email.

- Read and click on all terms and conditions of LIC HFL.

- You will be redirected to the payment gateway page.

- You will receive a payment summary after you complete your Net Banking Payments.

- You can ‘download receipts’ to acknowledge payment receipts.

- You will receive payment receipts on your email as well.

How to Obtain LIC Housing Loan Statements Online

- Visit LIC HFL Website.

- Select the ‘New Customer’ option.

- Enter the following information:

- The account number of your home loan.

- The amount sanctioned under your home loan.

- Date of birth.

- The security code displayed on the screen.

- Click on submit after completing the previous stages.

- Enter your personal information:

- Your Email ID.

- Your username and password.

- After completing these stages, you will receive an activation link from LIC HFL in your email.

- Click on the link from your email.

- Go back to the LIC HFL website and enter your username and password.

- After successful login, you will see:

- Your personal details.

- Your linked home loan details.

- You can view your home loan status report by selecting the option from the left-hand side of the menu.

- Select the ‘loan status report’ option and select the relevant home loan account number and click on ‘GO.’

- You can now view:

- The time period of your loan.

- Your LIC sanctioned loan amount.

- Your loan interest rate.

- Your loan disbursement date.

- Your status of EMI.

- Details of your principal and interest amount.

How to Generate LIC HFL Home Loan Repayment Statements

- Click on ‘Repay certificate’ from the left-hand side menu on the website.

- Select the home loan account number.

- Select the financial year ‘April of last year to March of the current year.’

- Click on ‘Go’ and your statement will be generated.

Why Should You Use the LIC HFL Customer Portal?

- To receive yearly repayment certificates.

- Access disbursement details.

- Repayment Schedule for the next 12 months.

- Access PDCs/ECS details.

- You can enquire and submit your query.

- You can make online payments.

Adding Loan Accounts to Your LIC HFL Profile

- Select the ‘Manage Loan’ option on the website.

- Click on the ‘add loan’ option.

- Type your loan account number with the sanction amount and the primary holder’s birth date.

- Your loan account will be added to your profile.

How to Revive Your LIC HFL Password

- Select the ‘Forget Password’ tab.

- Enter your username, birth date, and loan number.

- Enter your OTP, which will arrive on your mobile or email.

- Enter a code to verify your account.

- Your loan credentials will be sent to your mobile and email.

What Are the Features of LIC Home Loan?

- You will get home loan sanction facilities online.

- You will receive home loans at lower interest rates.

- LIC home loans can last for 30 years or until the attainment of 60 years, whichever is earlier.

- You will not receive a penalty on pre-payments.

- Finance is available for the construction/purchase of houses or flats purchased from private developers or housing boards.

- Finance is available for repairs and renovations.

- You can transfer your balance or take over your existing loan.

Different Types of LIC HFL Loans

Home Loans for Indian Residents

LIC’s Griha Suvidha Home loan is a mortgage-backed housing loan that allows people to buy their dream house. People are eligible for subsidies on this loan under the Pradhan Mantri Awas Yojana – Credit Linked Subsidy Scheme.

Loan for Salaried Person

The creditor needs to receive income through banking channels. Any income outside CTC (cost to company) like OT/Incentives/Bonus/Vehicle Charges or not reflective in Form no. 16, should be treated as additional income. The additional income cannot be more than 30% of your total income. Your loan will be age-restricted up to the age of retirement for loan calculation. If you are a primary borrower, your income should be at least 30,000 rupees monthly. However, if you apply for the joint borrower, your income should be 40,000 rupees monthly.

Loan for a Salaried Person with No Availability of Pension

Your loan is not capped to retirement age. You can extend your loan by ten years post your retirement age. Moreover, your tenure of the loan will last for 30 years. Your age to acquire a loan should not be more than 50 years.

Extension on Loan for Salaried

| Loan amount in Lakhs | LTV (%) | Rupees 10 – 75 | > Rupees 75 |

|---|---|---|---|

| Upto 65 years | 0.90% | 1.40% | |

| >65 – 75 | 1.15% | 1.55% | |

| >75 – 80 | 1.35% | NA | |

| >80 – 85 | 1.40% | NA | |

| >85 | 1.55% | NA |

Extension for Self-Employed

| Loan amount in Lakhs | LTV (%) | Rupees 10 – 75 | > Rupees 75 |

|---|---|---|---|

| Upto 65 years | 1% | 1.50% | |

| >65 – 75 | 1.30% | 1.75% | |

| >75 – 80 | 1.50% | NA | |

| >80 – 85 | 1.60% | NA | |

| >85 | 1.75% | NA |

Home Loans for NRI

LIC HFL provides loans to NRI (Non-Resident Indians) to buy housing property in India. LIC HFL provides home loans, plot loans, home improvement loans, home renovation loans, top-up loans, and balance transfer facilities.

Plot Loans

When You Purchase Plots from Government/Developmental Bodies/Approved Layout

You can avail of loans for purchasing plots for residential purposes from government-affiliated bodies. You can take a loan up to 75% of the total cost of the plot. This tenure will last for 15 years.

When You Purchase a Plot or Construct a House

You can avail of a loan if you can complete your house construction within 3 years from the date of purchase. You can use 60% of the loan amount to buy the plot, but the other 40% should be used to construct your house. This tenure will last for 30 years.

LIC HFL Home Loan Documents Needed

- KYC Documents: PAN card, Aadhaar card, proof of residence, for NRI – passport.

- Income Documents: Salary slip and form 16, bank statement of 6 and 12 months, last 3 years income tax return and financials for self-employed or professional.

- Property Documents: Proof of property ownership, allotment letter to the builder in case of flat, tax paid receipts.

Interest Rate on LIC HFL Home Loans

If your CIBIL score is above 750, then your interest on a home loan is 7.5%.

LIC HFL Maximum Loan Amount and the Time Period

- You will receive 90% of the total value of the property cost as a loan if the cost is Rs 30 lakhs.

- You will receive 80% of the total value of the property cost as a loan if the cost is above Rs 30 lakhs and below Rs 75 lakhs.

- You will receive 75% of the total value of the property cost as a loan if the cost is above Rs 75 lakhs.

- If you are a salaried employee, you will get 30 years to repay your loan amount.

- If you are self-employed, you will get 25 years to repay your loan amount.

Conclusion

LIC Housing Finance Limited offers a comprehensive range of home loan services tailored to meet the diverse needs of its customers. From easy online access to competitive interest rates, LIC HFL ensures a seamless experience for both Indian residents and NRIs. Whether you’re looking to buy a new home, construct a house, or renovate an existing property, LIC HFL has a solution for you. Utilize the LIC home loan calculator and LIC home loan EMI calculator to plan your finances better and make informed decisions.