Everything You Need to Know About IGR Maharashtra

If you’re a property buyer in Maharashtra, the Inspector General of Registration (IGR) Maharashtra is crucial for registering your sale deed at the Department of Registration and Stamps Maharashtra after paying the stamp duty and registration charges.

What is IGR Maharashtra?

IGR Maharashtra stands for Inspector General of Registration and Stamps in Maharashtra. This department collects revenue through stamp duty and other charges applicable on the registration of documents such as leave and license registration, mortgage, and more. Here’s everything you need to know about IGR Maharashtra, including property registration details and online document search.

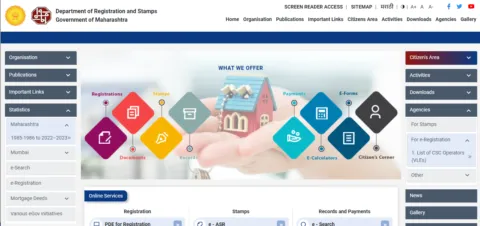

IGR Maharashtra is one of the most digitally advanced departments in the country. It has significantly reduced the need to visit the sub-registrar office for property document registration services. The department relies on modern technology to register and collect documents using well-defined procedures within a specific time frame and in a transparent manner.

The IGR Maharashtra website can be accessed in both English and Marathi languages and has recently been given a makeover.

Services Offered by IGR Maharashtra

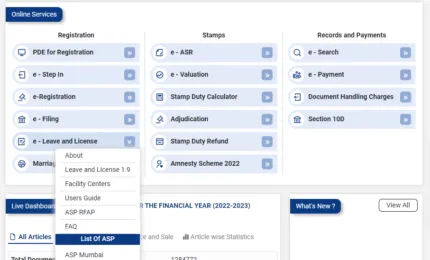

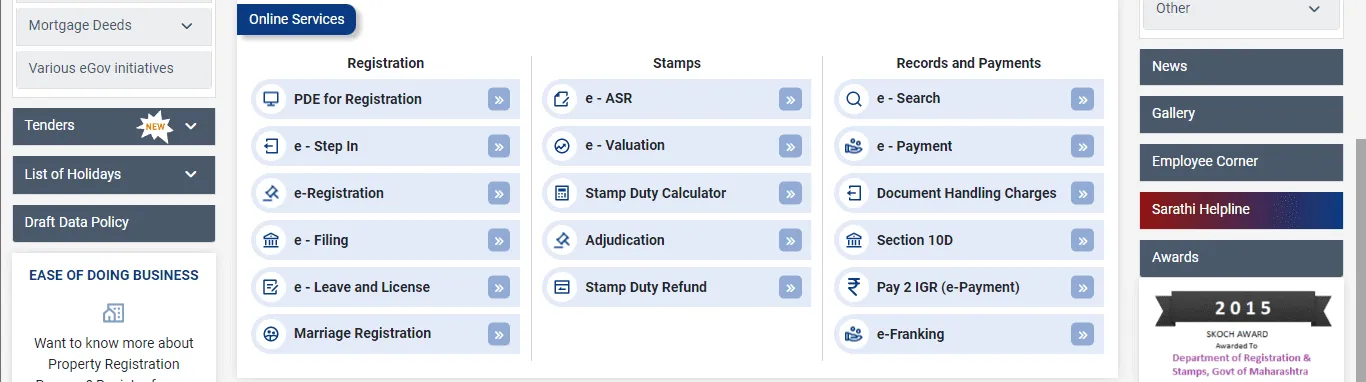

IGR Maharashtra offers a variety of services, including:

- Document registration

- Copy and search

- Stamp duty collection

- Valuation of property

- Filing of notices

- Stamp duty refund

- Deemed conveyance

- Marriage registration

- Registration of will

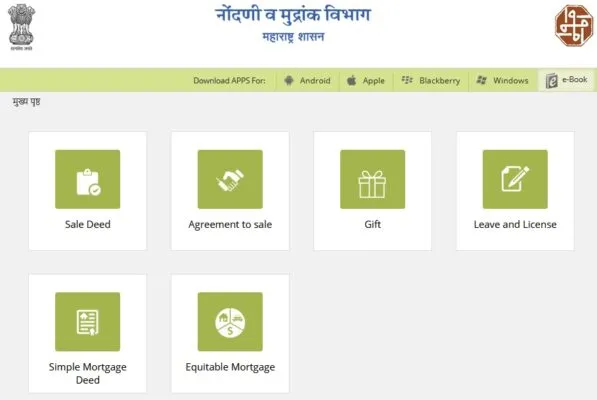

For instance, if you click on Document registration, you will be led to a page on IGR Maharashtra that looks like the image below. Click on the query you are interested in and proceed with an IGR Maharashtra online search.

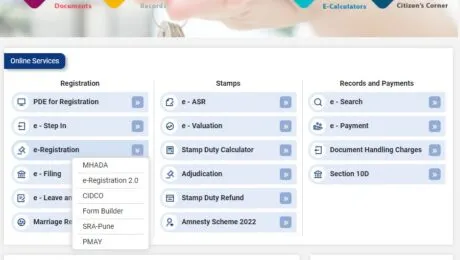

E-Registration of Property

This service is available for first-sale properties bought from MHADA, CIDCO, Form Builder, SRA-Pune, and PMAY. Click on the body with whom you want to opt for e-registration and proceed. For example, if you click on MHADA, you will reach the iSarita page to proceed with the e-registration.

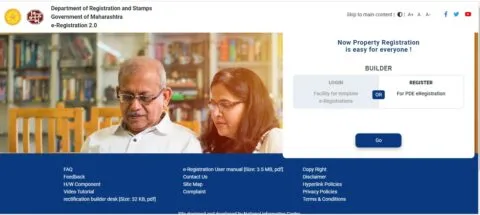

E-Registration 2.0

For e-registration between builders and property buyers, click on e-registration 2.0. You will reach iSarita 2.0 from where you can proceed by either logging in or opting for PDE registration.

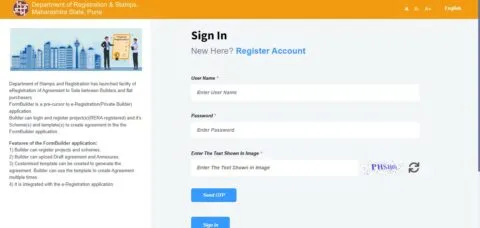

E-Registration Form Builder

IGR Maharashtra has launched the eRegistration of Agreement to Sale facility between builders and flat purchasers. Form builder is one step before the e-registration application where builders can log in, RERA register their projects and schemes, upload draft agreements and annexures, and create customized templates to generate registration agreements.

Enter your username, password, captcha, and click on send OTP. Once you receive the OTP, enter it and click on Sign in to proceed with the Formbuilder registration.

E-Filing of Mortgage Deeds

This service is available for banks as well as users.

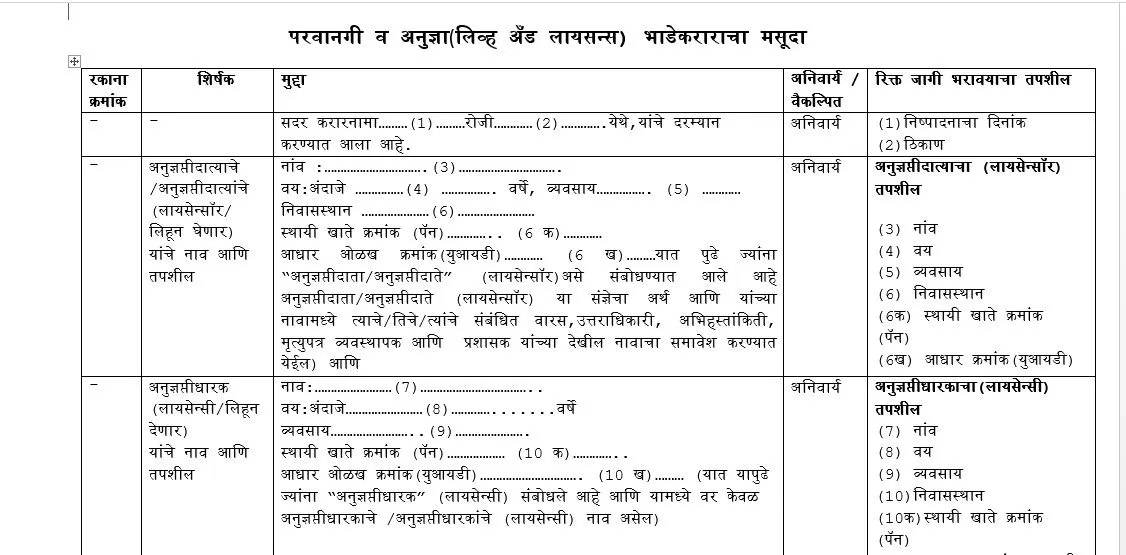

E-Leave and License

You can access this service by clicking on Leave and License 1.9. You will be directed to where you can make a new entry and proceed with eRegistration.

You can download the draft of the Leave and License Tenancy Agreement by clicking under the What’s new section.

IGR Maharashtra Online Search

IGR Maharashtra has developed a detailed document on data policy to adopt a Data Management Framework, initiating a data-driven transformation program. The IGR data policy can be accessed here.

Currently, as part of IGR Maharashtra online search on www.igrmaharashtra.gov.in online services, the department offers more than 60 applications providing various services to the citizens of Maharashtra, including online document search and property registration details. Some applications interact with other departments such as Income Tax, UIDAI, land records, MCGM, GRAS, etc., for data exchange during registrations and online document search.

To check IGR Maharashtra land records, please visit Maharashtra’s Mahabhumi MahaBhulekh website.

How to Check Registered Documents Online in Maharashtra

IGR Maharashtra online search or online document search in Maharashtra is now very easy. The E-search facility allows you to do an IGR Maharashtra online search. Searches include document search, property paper search, and checking earlier transactions with the help of a document registration number or survey number. The details accessed from this portal are for information purposes and are not certified by IGR Maharashtra.

There are two types of processes in IGR Maharashtra online search: free search and paid search.

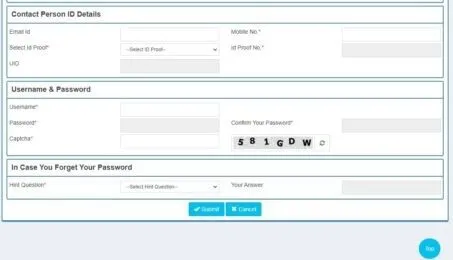

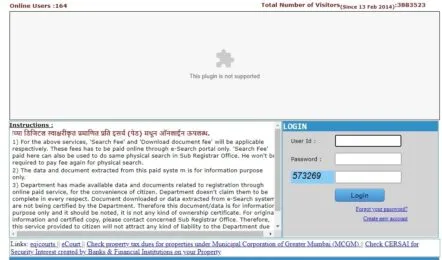

How to Create an Account on esearchigr.maharashtra.gov.in

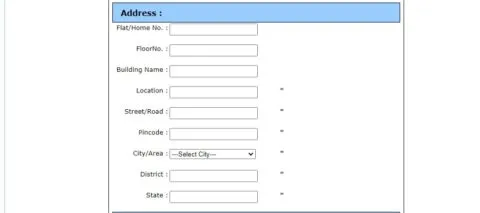

If you are a new user, first create an account by clicking on the ‘create new account’ link. Enter personal information including name, gender, nationality, mobile number, occupation, date of birth, email id, and PAN number.

Next, enter the address.

Next, enter the login information – user id, verify user id, password, captcha, and click on submit.

E-Search Free Service

For online document search, click on the e-search tab and select the free process for accessing IGR Maharashtra online document search. You can take advantage of the free service.

On selecting free service 1.9, you will reach Free Search IGR Service. Here you can do a property search or a document search.

In property details search, select parameters like:

- Year

- District

- Enter village name

- Select village

- Property number

- Name-based search (optional)

- Captcha

and click on Search.

In document search, select parameters including:

- Registration type (efiling/registration/regular)

- District

- SRO

- Year

- Doc no

- Captcha

and click on search to view results.

Integrated Portal for Registering Property

Click on the Integrated portal for registering property on the left side of the IGR Maharashtra page. You will reach Registering Property. Here you can check property transaction history, property tax due, and index of charges.

How to Get a Copy of Registered Document Online

For online document search, click on the e-search tab and select the paid process for accessing IGR Maharashtra online document search. You will reach E-Search Paid Process.

To proceed, select:

- District

- Enter a minimum of three characters of the area

and click on submit.

Next, select the area from the drop-down box, enter CTS number, survey number, gat number, plot number, flat number, and click on the search button to view results.

Since this is a paid service, you will have to make a payment using the e-Payment facility available under the online services tab on the Maharashtra IGR main page. On clicking payment, you will be led to GRAS.

For the e-Search option, you have to pay Rs 25 per property per year. However, a minimum search fee of Rs 300 has to be paid, and each time you search, money will be deducted from this. You will get a receipt for the payment done for the search. Note that the search fee paid online holds true for physical search in the sub-registrar’s office and doesn’t have to be paid again.

How to Calculate Stamp Duty

Stamp Duty is a tax a citizen has to pay for registering a property document in legal records with the Government. IGR Maharashtra stamp duty is applicable on the sale of property agreements, rental agreements, mortgage deeds, gift deeds, etc.

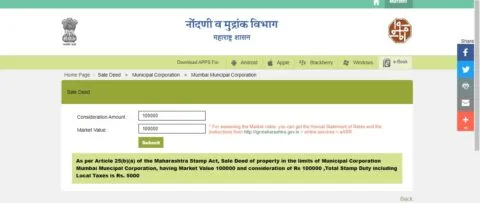

According to IGR Maharashtra, stamp duty is applicable at the rate of 3% to 7% of the total property consideration value. A user can calculate the stamp duty charges by using the stamp duty calculator on the IGR Maharashtra website. This can be done by entering the document details on the stamp duty calculator and getting an approximate value of the stamp duty.

Steps to Calculate Stamp Duty

- Visit IGR Maharashtra at igrmaharashtra.gov.in and click on the ‘Stamp Duty Calculator’ option under the ‘Online Services’ section.

- You will be redirected to a new page where you can select the type of document which needs to be registered.

- Select the ‘Sale deed’ option to register your property papers and then select the jurisdiction from: Municipal Corporation, Municipal Council, Cantonment, and Gram Panchayat.

- Enter the valuation-consideration value and market value to get the stamp duty amount displayed on the screen.

Stamp Duty and Registration Fees Payment

For payment of IGR Maharashtra stamp duty, you have two methods: online and offline. On calculating the stamp duty, you can pay using the Government Receipt Accounting System (GRAS) present on the Maharashtra IGR website. You can also pay the property registration charges on igrmaharashtra.gov.in.

Online Payment Method

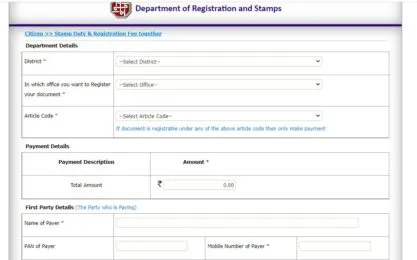

- Go to GRAS.

- If you have a registered username and password, you can log in and proceed. If not, create a user account by clicking on the create user account and filling in the details.

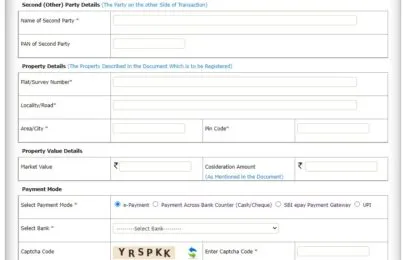

- Alternatively, you can pay without registration by clicking on ‘Pay without registration’. Select ‘Make payment to register your document’ and then choose one of the three options: pay stamp duty and registration fee together, pay stamp duty only, or pay registration fee only.

- Fill in the required details and proceed with the payment.

1% Rebate in Stamp Duty for Women

To encourage women buyers to invest in real estate, Maharashtra state offers a 1% rebate in stamp duty for women property buyers. Hence, the stamp duty to be paid by women buyers stands at 5% of the property value, while men pay 6%.

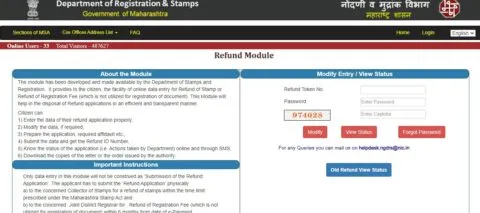

Stamp Duty Refund

The Maharashtra Stamp Act, 1958, allows a refund of stamp duty if the purpose of its use is canceled, if the stamp is damaged before its use, or if it is overpaid. To apply for a refund, submit the application to the stamp collector from where the stamps were purchased, along with the necessary documents within the prescribed time and format.

Documents Required for Stamp Duty Refund

- Online information filling token.

- Document with original stamp.

- Affidavit of the person, if the stamp is purchased by hand.

- Authorized letter or certified copy of power of attorney, if an authorized person is applying for the refund.

If the stamps were purchased by franking:

- Invoice of the franchise stamp dealer, accruing stamp duty to the government.

- Stamp sale certificate/excerpt of stamp sales register.

For seamless stamp duty refund, visit IGR Maharashtra and click on the stamp duty refund tab on the main page.

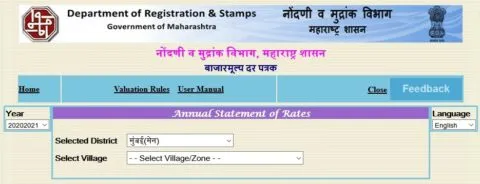

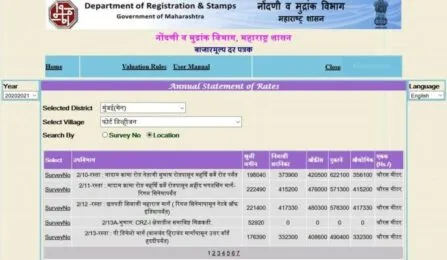

Ready Reckoner Rates 2024-25

IGR Maharashtra ready reckoner rates are the government-decided price below which properties in an area cannot be transferred in the government’s records. This pre-fixed rate, which is changed from time to time by states, is also known as guidance value or circle rate. In Maharashtra, it is most commonly known as the ready reckoner rate or RR rate.

How to Check Land Records

To check IGR Maharashtra land records, visit Maharashtra’s MahaBhulekh website at MahaBhulekh. You can check the 7/12 records, property card, and mojni. Additionally, you can also access form 8A and form 6 on the website and find details with respect to your land.

Index 1, 2, 3, and 4

The Department of Registration and Stamps Maharashtra has four types of indices:

- Index 1: Prepared according to the initial of the parties’ names in the document.

- Index 2: Prepared according to the village name in the document.

- Index 3: Prepared for Wills.

- Index 4: Prepared for movable property.

Online Search Index 2

The Index 2 online property document download extract is issued by the IGR Maharashtra Department. It serves as an official record of a document or transaction recorded in the records of the registering authority, confirming that the transaction has been completed.

What is Index 2 Online?

Index 2 contains the following information:

- Type of document: Sale Deed, Agreement for Sale, Gift Deed, Transfer, Mortgage Deed, Exchange of property, etc.

- Consideration amount of property.

- Detail of the property, such as municipal jurisdiction, zone and sub-zone with landmark, property description such as CTS number, survey number, hissa number, gat number, floor number, etc.

- Built-up area of the property in sq meters.

- Nature of the property, such as land, residential unit (flat/room/bungalow), commercial unit (office/shop), and industrial unit.

- Name of the parties: vendor(s) – vendee(s) / transferor(s) – transferee(s) / assignor(s) – assignee(s), etc.

- Execution date.

- Registration serial number.

- Stamp duty amount.

- Registration fee.

Property Registration Details on iSarita 2.0

From September 23, 2021, onwards, the newly-developed iSarita 2.0 will be used for document registration in SRO Haveli 21 and 23, Pune. Those who want to register with IGR in these offices have to use PDE 2.0 and eStepin 2.0, as the older versions of both are incompatible with iSarita 2.0.

Notice of Intimation

IGR Maharashtra now permits you to file the ‘Notice of Intimation’ (NOI) online for mortgage or loan deposit title deed without the need to go to the sub-registrar’s office (SRO). This service is live all across Maharashtra. To do so, click on the ‘online services’ tab on the IGR Maharashtra homepage and then select ‘filing (for citizens)’ and click on ‘Process efiling’.