Understanding HSN Code: A Comprehensive Guide

Since more than 98% of the goods traded internationally are classified by an HSN code, it becomes crucial for traders across the world to understand what this code means. Let’s dive into the details of the HSN code, its structure, and its significance in global trade.

What is HSN Code?

HSN code full form is Harmonized System of Nomenclature. It is a globally standardized system of names and numbers to classify traded products. The HSN code is issued by the World Customs Organization (WCO) and is used by over 200 countries.

Importance of HSN Code

The HSN code enables the WCO members to maintain a global database of goods. This system helps in the uniform classification of goods, which is essential for international trade. The WCO periodically updates the HSN codes to reflect changes in global trade patterns. For instance, HSN 2022, the seventh edition, became effective on January 1, 2022, and includes new fields of trade.

HSN Code Structure

HSN codes are meticulously organized into:

- 21 sections

- 97 chapters

- 1,244 headings

- 5,224 subheadings

For example, in India, the HSN code for pan-masala containing tobacco (Gutkha) is 24039990. Here, 24 is the chapter number, 03 is the heading, 99 is the sub-heading, and 90 is for a clearer classification of the tariff item.

Digits in the HSN Code

A detailed HSN code can have up to 12 digits. The first six digits are universally accepted, while the last six digits are added based on the source country, tariff, and statistical requirements. Here’s how the digits are structured:

- The first two digits designate the HSN chapter.

- The next two digits designate the HSN heading.

- The last two digits designate the HSN subheading.

However, many developed countries use 10-digit HSN codes, while India uses 8-digit HSN codes.

HSN Code in India

Under the Goods and Services Tax (GST) regime in India, all goods and services are classified under the Services and Accounting Code (SAC), which is based on HSN codes. This classification helps in the clear recognition, measurement, and taxation of goods and services under GST.

HSN Code Search in India

To search for an HSN code in India, follow these steps:

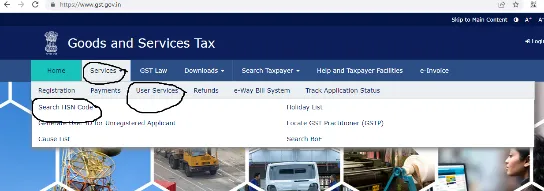

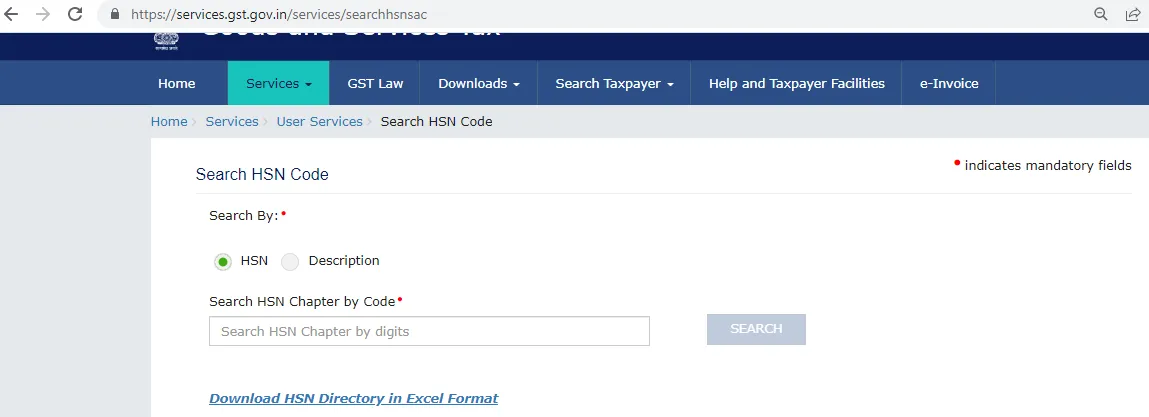

- Go to the official GST web portal. Under the ‘Services’ tab, select the ‘User Service’ option and then the ‘Search HSN Code’ option.

- You can search the HSN code by providing the chapter number or the product description.

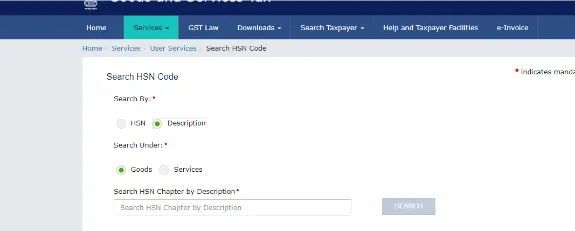

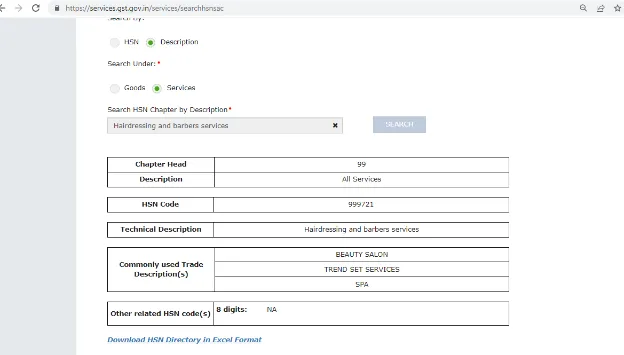

- If you are unsure of the HSN chapter number, select ‘Description’ and then either ‘goods’ or ‘services’.

- Select your description. The HSN code will appear on the screen, and you can download it in an Excel sheet.

HSN Code List

The HSN system codes over 10,000 separate categories of products. These codes are organized into sections, chapters, headings, and sub-headings. Here are some examples:

Section 1: Live Animals and Animal Products

- 0101-2022E: Live animals

- 0102-2022E: Meat and edible meat offal

- 0103-2022E: Fish, crustaceans, molluscs, and other aquatic invertebrates

- 0104-2022E: Birds’ eggs, dairy produce, natural honey, edible products of animal origin, not elsewhere specified or included

- 0105-2022E: Products of animal origin that are not elsewhere included or specified

Section 2: Vegetable Products

- 0206-2022E: Live trees and other plants, roots, bulbs, and the like, cut flowers and ornamental foliage

- 0207-2022E: Edible vegetables and certain tubers and roots

- 0208-2022E: Edible fruits and nuts, citrus fruit or melon peels

- 0209-2022E: Coffee, tea, maté, and spices

- 0210-2022E: Cereals

Section 3: Animal, Vegetable, or Microbial Fats and Oils

- 0315-2022E: Vegetable, animal, or microbial oils and fats and their cleavage products, prepared edible fats, vegetable or animal waxes

Section 4: Prepared Foodstuffs, Beverages, Spirits, and Tobacco

- 0416-2022E: Preparations of meat, fish, crustaceans, molluscs, or other aquatic invertebrates, or insects

- 0417-2022E: Sugars and sugar confectionery

- 0418-2022E: Cocoa and cocoa preparations

- 0419-2022E: Preparations of cereals, starch, flour, or milk, pastrycooks’ products

- 0420-2022E: Preparations of fruits, vegetables, nuts, or other parts of plants

Section 5: Mineral Products

- 0525-2022E: Salt, sulphur, earths and stone, lime and cement, plastering materials

- 0526-2022E: Ores, slag, and ash

- 0527-2022E: Mineral oils and fuels, and products of their distillation, mineral waxes, bituminous substances

Section 6: Products of the Chemical and Allied Industries

- 0628-2022E: Inorganic chemicals, organic or inorganic compounds of rare-earth metals, of precious metals, of radioactive elements, or of isotopes

- 0629-2022E: Organic chemicals

- 0630-2022E: Pharmaceutical products

- 0631-2022E: Fertilisers

- 0632-2022E: Tanning or dyeing extracts, tannins and their derivatives, pigments, dyes, and other colouring matter, varnishes and paints, putty and other mastics, inks

Section 7: Plastics and Articles Thereof

- 0739-2022E: Plastics and articles thereof

- 0740-2022E: Rubber and articles thereof

Section 8: Raw Hides and Skins, Leather, Fur Skin, and Articles Thereof

- 0841-2022E: Raw hides and skins (other than fur) and leather

- 0842-2022E: Articles of leather, harness and saddlery, travel goods, handbags, and similar containers, articles of animal gut (other than silkworm gut)

- 0843-2022E: Fur skins and artificial fur, manufactures thereof

Section 9: Wood and Articles of Wood

- 0844-2022E: Wood and articles of wood, wood charcoal

- 0845-2022E: Cork and articles of cork

- 0846-2022E: Manufactures of straw, of esparto or other plaiting materials, basket ware, and wickerwork

Section 10: Pulp of Wood or Other Fibrous Cellulosic Material

- 0847-2022E: Pulp of wood or other fibrous cellulose material, recovered (scrap and waste) paper or paperboard

- 0848-2022E: Paper and paperboard, articles of paper, paper pulp, or paperboard

- 0849-2022E: Newspapers, printed books, pictures, and other printing industry products, manuscripts, typescripts, and plans

Section 11: Textiles and Textile Articles

- 1150-2022E: Silk

- 1151-2022E: Wool, coarse or fine animal hair, horsehair yarn, and woven fabric

- 1152-2022E: Cotton

- 1153-2022E: Other vegetable textile fibres, paper yarn, and woven fabrics of paper yarn

- 1154-2022E: Man-made filaments, strips, and the like of man-made textile materials

Section 12: Footwear, Headgear, Umbrellas, and Walking Sticks

- 1264-2022E: Footwear, gaiters, and the like, parts of such articles

- 1265-2022E: Headgear and parts thereof

- 1266-2022E: Umbrellas, sun umbrellas, walking sticks, seat-sticks, whips, riding-crops, and parts thereof

- 1267-2022E: Prepared feathers and down and articles made of feathers or down, artificial flowers, articles of human hair

Section 13: Articles of Stone, Plaster, Cement, Asbestos, Mica, or Similar Materials

- 1368-2022E: Articles of stone, cement, plaster, asbestos, mica, or similar materials

- 1369-2022E: Ceramic products

- 1370-2022E: Glass and glassware

Section 14: Natural or Cultured Pearls, Precious or Semi-Precious Stones

- 1471-2022E: Natural or cultured pearls, precious/semi-precious stones, precious metals, metals clad with precious metal and articles thereof, coins, imitation jewellery

Section 15: Base Metals and Articles of Base Metals

- 1572-2022E: Iron and steel

- 1573-2022E: Articles of iron or steel

- 1574-2022E: Copper and articles thereof

- 1575-2022E: Nickel and articles thereof

- 1576-2022E: Aluminium and articles thereof

Section 16: Machinery and Mechanical Appliances

- 1684-2022E: Nuclear reactors, boilers, machinery, and mechanical appliances, parts thereof

- 1685-2022E: Electrical machinery and equipment and parts thereof, sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles

Section 17: Vehicles, Aircraft, Vessels, and Associated Transport Equipment

- 1786-2022E: Railway or tramway track fixtures and fittings and parts thereof, railway or tramway locomotives, rolling stock and parts thereof, mechanical and electro-mechanical traffic signalling equipment of all kinds

- 1787-2022E: Vehicles other than tramway or railway rolling stock, and parts and accessories thereof

- 1788-2022E: Aircraft, spacecraft, and parts thereof

- 1789-2022E: Ships, boats, and floating structures

Section 18: Optical, Photographic, Cinematographic, Measuring, Checking, Precision, Medical or Surgical Instruments

- 1890-2022E: Optical, cinematographic, photographic, measuring, checking, precision, surgical or medical instruments and apparatus, parts and accessories thereof

- 1891-2022E: Clocks and watches and parts thereof

- 1892-2022E: Musical instruments, parts and accessories of such articles

Section 19: Arms and Ammunitions

- 1993-2022E: Arms and ammunition, parts and accessories thereof

Section 20: Miscellaneous Manufacturing Articles

- 2094-2022E: Furniture, mattresses, mattress supports, bedding, cushions, and similar stuffed furnishings, lighting fittings and luminaires, not elsewhere specified or included, illuminated signs, name-plates, and the like, prefabricated buildings

- 2095-2022E: Toys, games, and sports requisites, parts and accessories thereof

- 2096-2022E: Miscellaneous manufactured articles

Section 21: Works of Art, Collectors’ Pieces, and Antiques

- 2197-2022E: Works of art, collectors’ pieces, and antiques

Conclusion

Understanding the HSN code is essential for anyone involved in international trade. It ensures that goods are classified uniformly, which simplifies the process of trade and taxation. By following the steps outlined above, you can easily search for HSN codes in India and ensure that your goods are correctly classified.