Understanding DLC Rates in Rajasthan: A Comprehensive Guide

If you’ve recently purchased a property in Rajasthan, the next crucial step is to get the sale deed registered. This process involves paying stamp duty to the government. But here’s the million-dollar question: Should you pay stamp duty based on the actual sale price of the property or the District Level Committee (DLC) rate, which is the government’s valuation of the property?

What is DLC Rate?

DLC rate stands for District Level Committee rate. It is the minimum rate at which the stamp duty is calculated. Essentially, it’s the government’s way of ensuring that property transactions are not undervalued to evade stamp duty.

What is the DLC Rate of Land?

The DLC rate of land is the minimum value below which land in Rajasthan cannot be registered at the time of ownership transfer. Stamp duty calculation on the deal takes place based on the DLC rate of land. In different parts of India, this rate is known by various names: circle rate in North India, guidance value in South India, and ready reckoner rate in Maharashtra.

How is DLC Rate Calculated?

Case 1: When DLC is Lower Than the Actual Sale Price

Suppose Aarti Khandelwal buys a residential property worth Rs 50 lakh. The DLC rate of this property is Rs 40 lakh. However, Khandelwal will need to pay stamp duty on the higher value, which is Rs 50 lakh.

Case 2: When DLC is Higher Than the Actual Sale Price

Suppose N Sundarajan buys a property worth Rs 60 lakh, and the DLC rate for this property is Rs 65 lakh. Therefore, Sundarajan will have to pay stamp duty on the higher of the two, which is Rs 65 lakh.

How to Calculate Property Value with DLC Rate in Rajasthan?

To determine the value of a property based on the DLC (District Land Committee) rate in Rajasthan, you can use the following formula:

Value of Property = DLC Rate x Built-up Area of the Property (in square meters)

For instance, if the DLC rate is Rs 5,000 per square meter and the property’s built-up area is 750 square meters, you can calculate the property’s value as follows:

Value of Property = 5000 x 750 = Rs 37,50,000

It’s important to note that when it comes to paying stamp duty, it is calculated based on the higher value between the property’s actual value and the DLC rate in Rajasthan.

How and Where to Find the DLC Rates?

To get the correct DLC rate, you will have to check the government websites. These rates are revised and updated from time to time, so make sure that you are referring to the current DLC rates.

DLC Rate: Other Names by Which It Is Known in India

While DLC rate is a term largely used in Rajasthan, it is known by other names in the rest of the country.

| State | Term |

|---|---|

| Rajasthan | DLC rate |

| Maharashtra | Ready reckoner rate |

| Delhi, Uttar Pradesh, Uttarakhand | Circle rate |

| Haryana, Punjab | Collector rate |

| Karnataka | Guidance value |

| Tamil Nadu | Guideline value |

| Telangana | Unit rate |

| Chhattisgarh, Madhya Pradesh | Market value guideline |

DLC Rates Classification

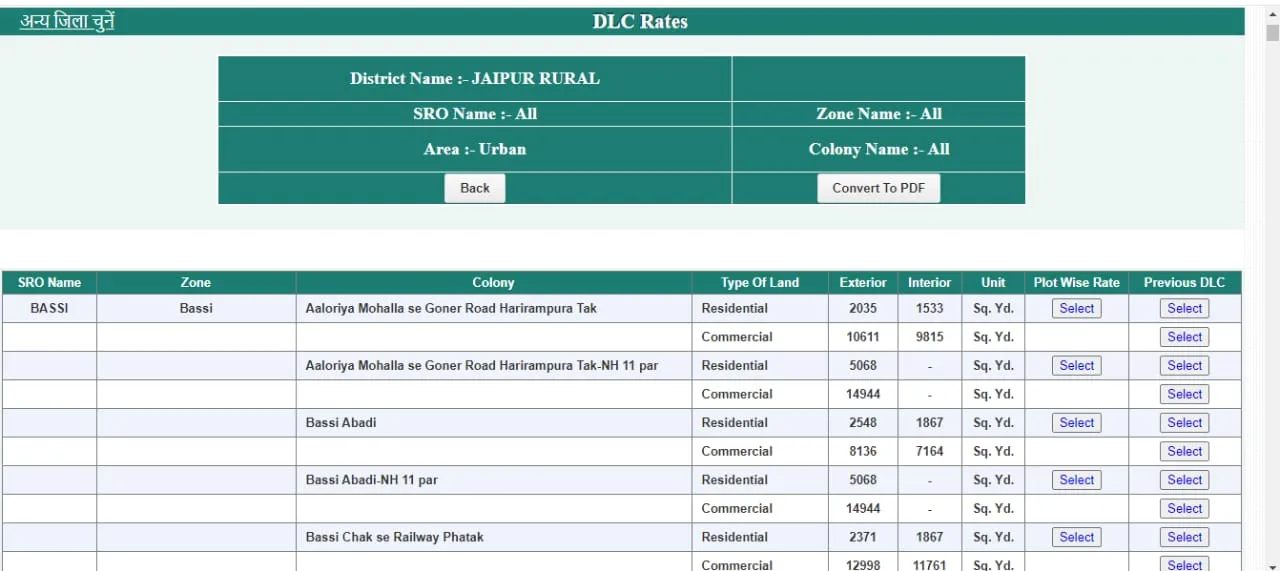

The DLC rates can be classified into four different broad heads: residential, commercial, institutional, and industrial. The residential and commercial categories can further be sub-divided into the exterior and the interior. The DLC rates are defined and formulated by the authorities accordingly.

How Do the Categorisations of DLC Rates Happen?

Residential Land or Property

Residential land or property can be categorized as premises meant for residential usages only. This can include farmhouses and flats. Residential premises that are rented or guest houses are also part of this category.

Commercial Land or Property

Commercial land or property can be categorized as premises meant for commercial purposes. Showrooms, retail shops, eateries, godowns, gardens, multiplexes, cinema halls, restaurants, cafes, and banquets outside hotel premises are considered commercial properties.

Institutional Land or Property

Institutions include all educational, medical, government, and community centers. This is a huge list that entails yoga centers, gas stations, booking stations, etc.

Industrial Land or Property

Industrial land and property are premises meant for industrial purposes and are registered under the Industrial Department of the government of Rajasthan. Examples of such properties are canteens and small cafeterias in factories and industrial workplaces meant for industrial workers.

What is Exterior and Interior DLC Rate?

The DLC rate can be easily divided into two categories: the DLC exterior and the interior. These are categorized and defined by their proximity to the road. If the property or land is beside the main road, the DLC exterior is applicable. However, if the property or land is not beside the main road, the DLC interior is applicable. These categories apply to both residential and commercial properties.

How to Check the Current DLC Rate in Rajasthan on E-panjeeyan?

You can check the DLC rate on the IGRS Rajasthan website.

Step 1: Log on to the IGRS Website

Visit IGRS Rajasthan and on the homepage, click on e-Value (Online DLC).

Step 2: Select the District

Select the district and click on submit.

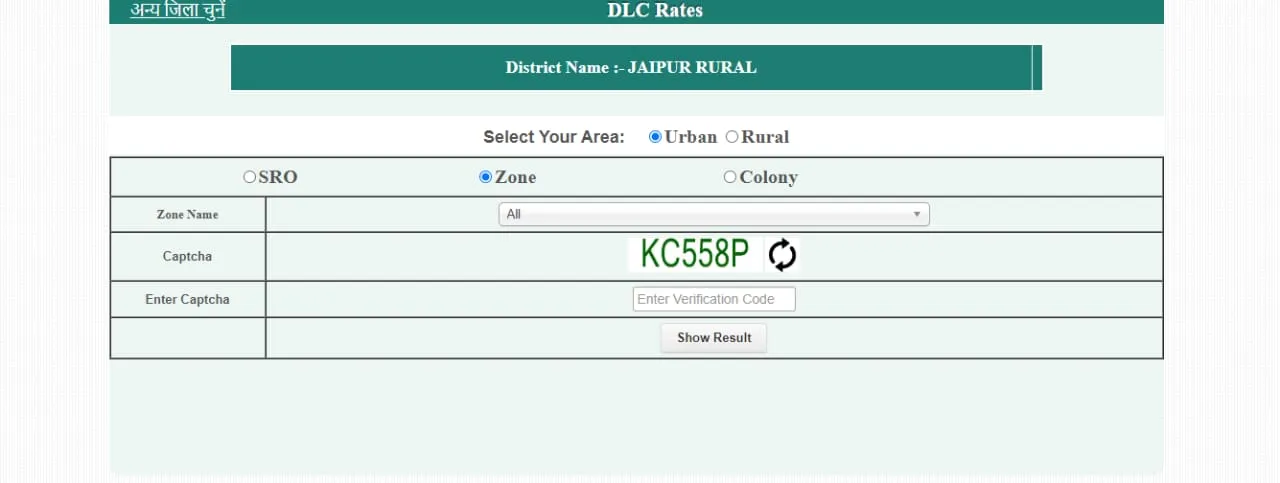

Step 3: Select Area and Other Categories

Select the area and other categories such as SRO, Zone, and Colony. Enter the Zone name, Captcha, and click on show result.

You will see the Jaipur DLC rates.

DLC Rate Latest Updates

DLC Rate in Jaipur Increased by 10% from April 1

Starting April 1, the DLC rate in Jaipur has undergone a revision and has been increased by 10%. With this, the stamp duty and registration charges in the city will also see a surge.

The DLC rate in Jaipur is decided by the Jaipur Nagar Nigam (Jaipur Municipal Corporation). It refers to the minimum rate notified by the state government through the registrar/sub-registrar’s office of Jaipur for the registration of property transactions. The stamp duty will be paid on the higher of the declared transaction value and the value computed based on the circle rate chart applicable for an area/sector in the city. You can check real estate-related services and details on epanjiyan Rajasthan.

BhuMe.in POV

Although the Jaipur DLC rate has been increased by 10%, the stamp duty rebate announced by the state last year remains as per industry reports. It’s always a good idea to avail the stamp duty rebate before rules change on that front.

Conclusion

Understanding the DLC rate is crucial for anyone involved in property transactions in Rajasthan. Whether you’re a buyer or a seller, knowing how the DLC rate affects stamp duty can save you from unexpected costs. Always make sure to check the latest rates and updates from reliable government sources to stay informed.